by Peter Schiff, Schiff Gold:

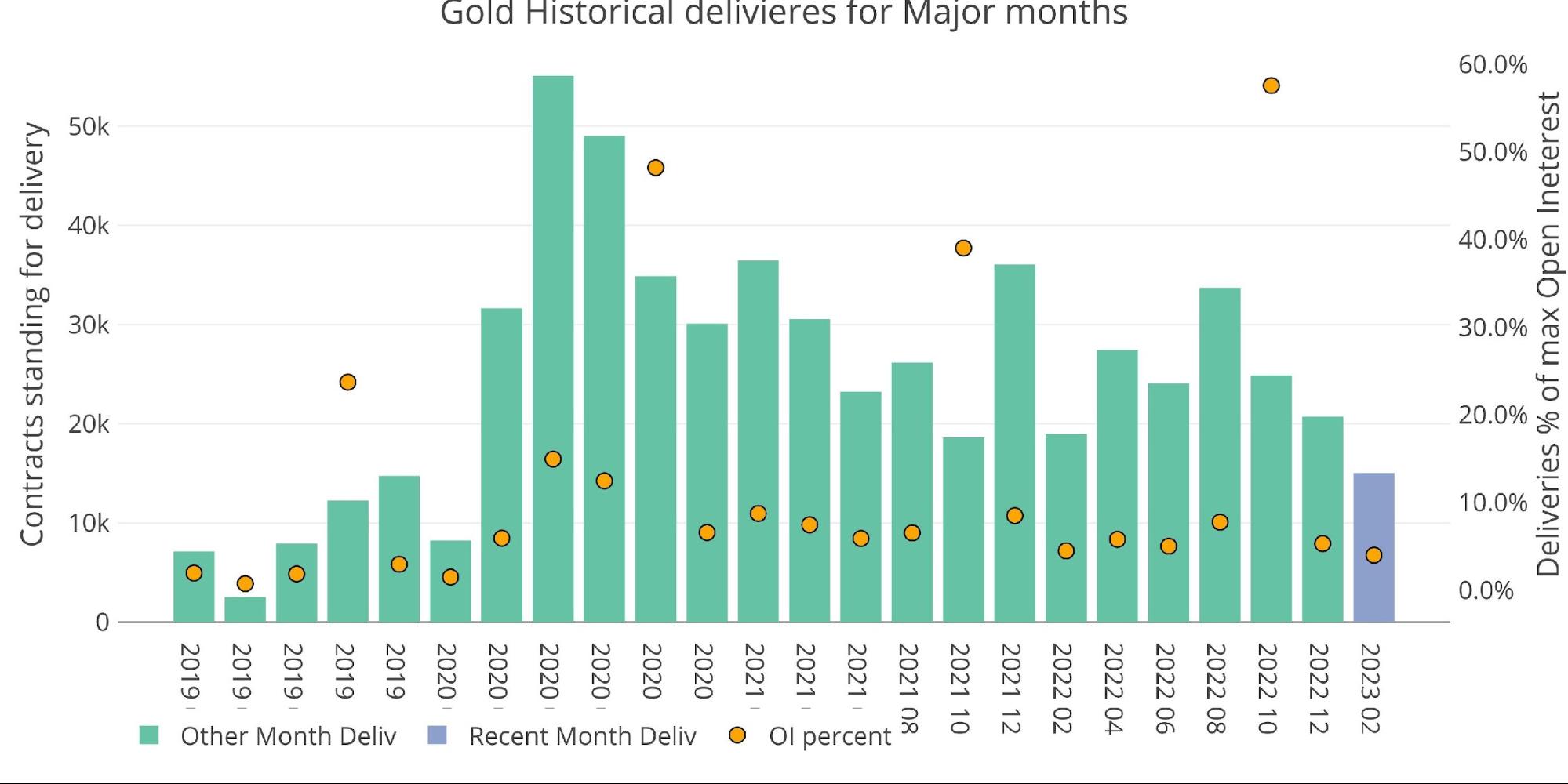

Gold deliveries in February came in quite low for a major month, totaling only 15,055. This is the lowest month going back to February 2020 (pre-Covid). The chart below shows the big spike in deliveries seen after Covid started. While the current month is still above any pre-Covid month, it is small when compared to some of the major delivery months seen recently.

TRUTH LIVES on at https://sgtreport.tv/

As noted in previous articles, this may be by design. Silver has been leading gold, and saw delivery volumes drop about a year ago. The theory is that there is simply not much metal available for delivery so the Comex is instead pushing people away from delivery.

Figure: 1 Recent like-month delivery volume

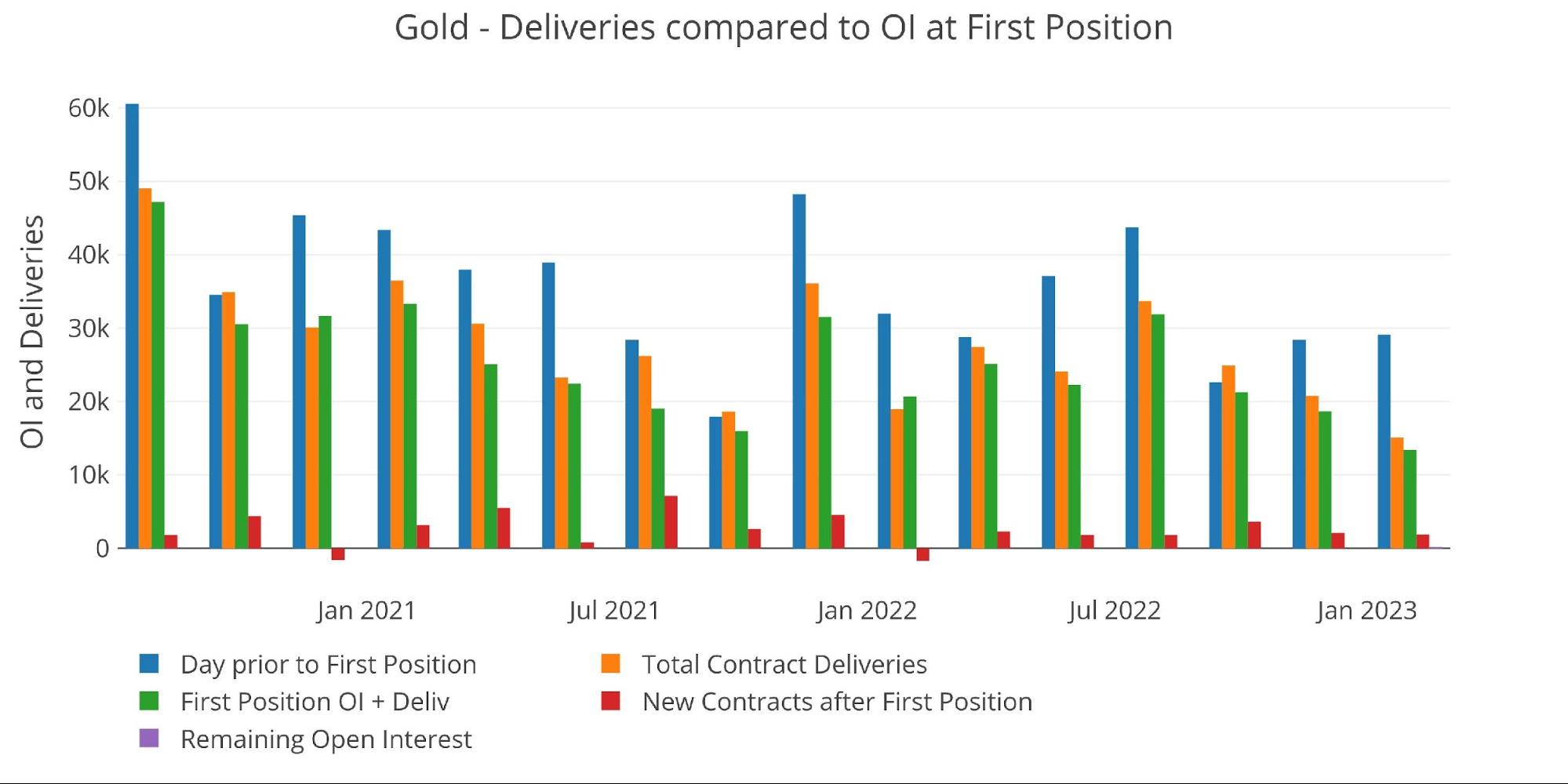

The hypothesis can be seen in the chart below with the drop of open interest into the close. On the day before First Notice, open interest was actually higher than December and several other months (blue bar). On the final day into the close, there was a massive drop in open interest. The final amount is the green bar below. This was a drop of over 50% on the final day! Large drops in the past have been 30%. This hints at the fact that the contract holders are waiting until the last minute to roll and then find some incentive to do so.

Figure: 2 24-month delivery and first notice

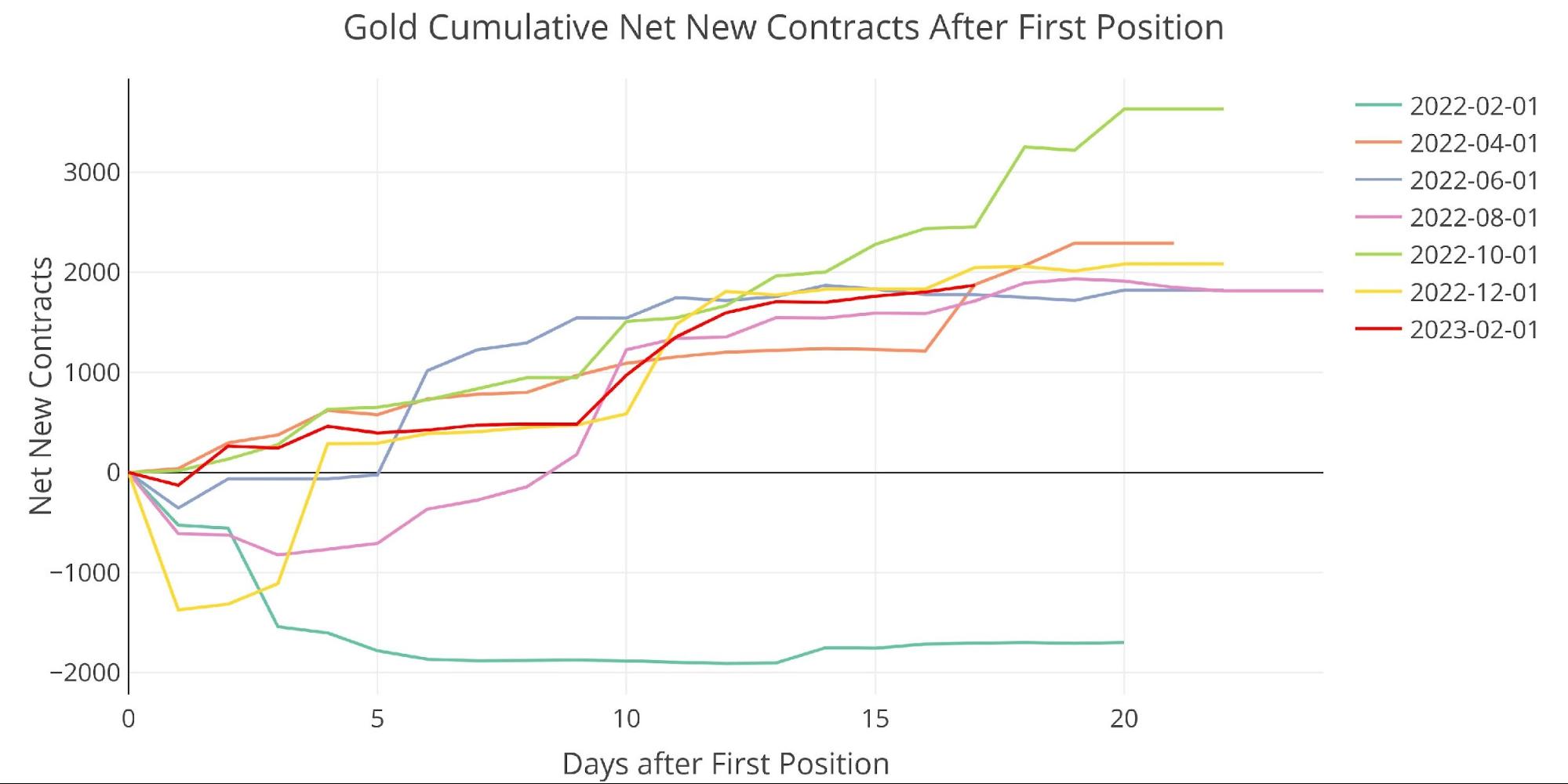

February did see a healthy number of contracts open for immediate delivery. Around 2000 has been the norm, and this month was no different.

Figure: 3 Cumulative Net New Contracts

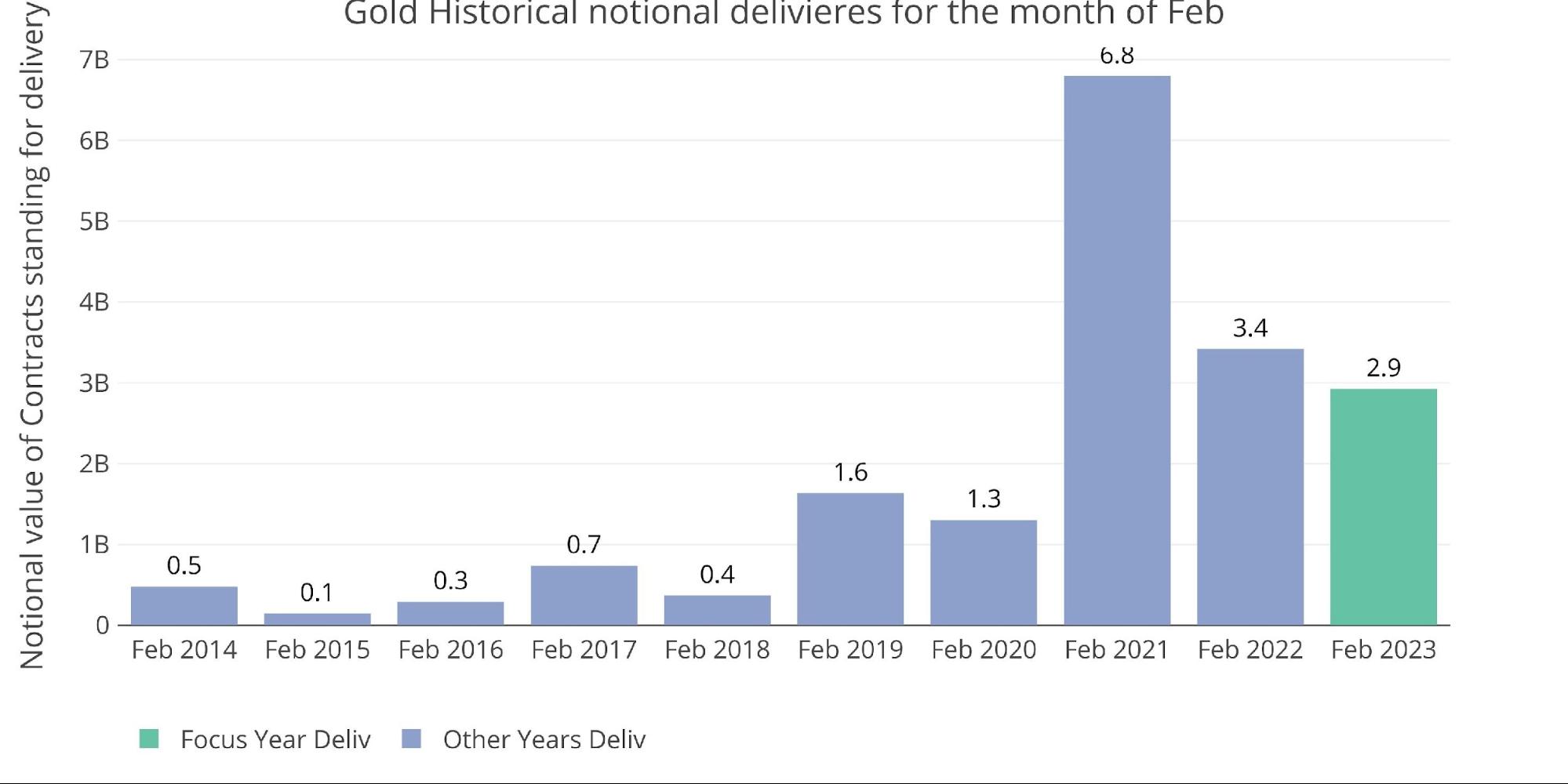

This will be the weakest February in three years from a notional amount. Total deliveries will come in at around $3B.

Figure: 4 Notional Deliveries

BofA was back in the market, restocking its inventory. As has been the case, they seem to love buying when prices are high (prices were above $1900 in early Feb), and then delivering out metal when prices fall. This has been quite unprofitable for BofA, as they are consistently buying high and selling low. A better explanation is that they are the backstop to give confidence to the gold market. In this case, some trading losses mean little if it shores up confidence in the gold market. A loss of confidence would lead to massive losses for anyone holding short paper contracts!