from ZeroHedge:

Update (9:52am ET). According to the NYSE, as of 9:48am, all systems are back to normal, although that is an understatement in a market where nobody knows what the correct opening price is! We are still waiting for the NYSE to give a detailed explanation of what caused this latest “broken markets” episode.

TRUTH LIVES on at https://sgtreport.tv/

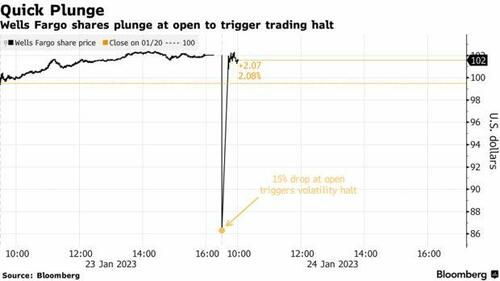

While it is still unclear what was the “technical glitch” that sent the world’s biggest companies into a multi-trillion market cap rollercoaster, Bloomberg reports that “a wave of sell orders targeting financial services stocks swept across American equity exchanges at the open of trading Tuesday, sending companies including Wells Fargo & Co. and Morgan Stanley to brief but sharp plunges from which they mostly quickly recovered.”

After closing Monday at $45.03, Wells Fargo fell as low as $38.10 before bouncing back, while Morgan Stanley plunged to $84.93 after ending at $97.13 on Monday.

That may be accurate, it’s not comprehensive as virtually every NYSE-listed stock was slammed at the open, only to rebound powerfully before tumbling once more. Indeed, as noted below, other impacted stocks included the likes of Walmart, McDonald’s and Exxon. These stocks saw drops of at least 12% before they were halted. Their moves have now rebounded to less than 1% in either direction.

Separately, at least 40 S&P 500 Index stocks were hit with trading halts. Other impacted shares included the likes of Walmart Inc. and McDonald’s Corp. These stocks saw drops of at least 12% before they were halted. Their moves have now rebounded to less than 1% in either direction.

“It’s a little concerning,” Oanda senior market analyst Ed Moya told BBG. “These are not your typical meme stock, easily manipulated companies, these are Morgan Stanley, Verizon, AT&T, these are some of the giants.”

Tuesday’s transactions occurred in New York Stock Exchange-listed securities and took place on virtually every trading platform, including ones overseen by CBOE Global Markets and private venues reporting to the Finra trade reporting facility.

The start of trading in most American stocks involves a complicated but usually routine process called the opening auction, designed to limit volatility resulting from orders for shares that pile up before the start of the regular session. In it, a computer balances out supply and demand for a particular stock by establishing an opening price that can be viewed as the level that satisfies the largest possible number of traders.