from ZeroHedge:

For over a year, we have been dutifully tracking several key datasets within the auto sector to find the critical inflection point in this perhaps most leading of economic indicators which will presage not only a crushing auto loan crisis, but also signal the arrival of a full-blown recession, one which even the NBER won’t be able to ignore, as the US consumers are once again tapped out. A month ago we said that in our view “that moment has now arrived”; the latest data from Fitch confirms as much.

TRUTH LIVES on at https://sgtreport.tv/

But first, for those readers who are unfamiliar with the space, we urge you to read some of our recent articles on the topic of car prices – which alongside housing, has been the biggest driver of inflation in the past 18 months – and more specifically how these are funded by the US middle class, i.e., car loans, and last but not least, the interest rate paid for said loans. Here are a few places to start:

- Are We Headed For An “Auto Loan Crisis” As Delinquencies Begin To Rise? – July 7

- A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market – July 25

- American Drivers Go Deeper Into Debt As Inflation Pushes Car Loans To Record Highs – Aug 29

- Credit Card Rates Just Hit A Record As The Average Car Loan Rises To Fresh All Time High – Oct 9

- New-Car Loan-Rates Set To Hit 14-Year High As Affordability Crisis Worsens – Nov 3

- Perfect Storm Arrives: “Massive Wave” Of Car Repossessions And Loan Defaults To Trigger Auto Market Disaster, Cripple US Economy – Dec 18

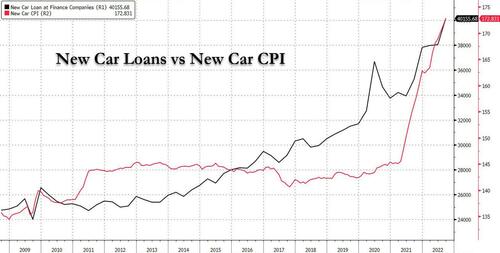

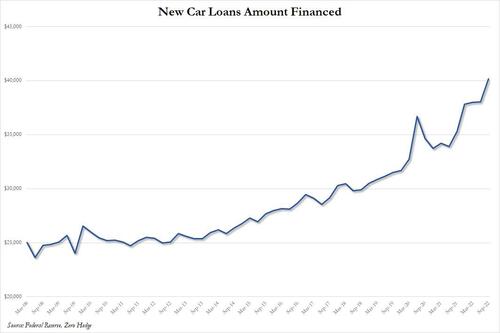

So while the big picture is clear – Americans are using ever more debt to fund record new car prices – fast-forwarding to today, we have observed two ominous new developments: the latest consumer credit report from the Fed revealed a dramatic spike in the amount of new car loans, which increased by more than $2,000 in one quarter, from just over $38,000 (a record), to $40,155 (a new record).

Now this shouldn’t come as a shock: a simple reason why new car loans have hit record highs is simply because new car prices have also soared to all time highs, as the next chart shows.

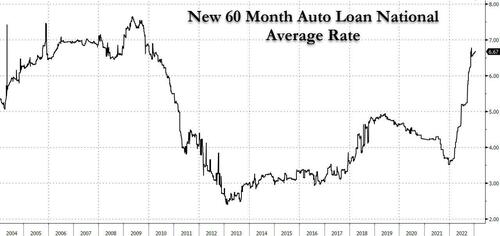

Here we will ignore for the time being cause and effect, or “chicken or egg” questions – i.e., whether record new car prices are the result of easy record credit, or whether record new car loans are simply tracking the explosive surge in car prices, and instead focus on something even more ominous: the explosion in the average interest rate on a new 60 month auto loans: according to Bankrate, as of Jan 27, the number is just over 6.67%, almost doubling since the start of 2022, and the highest in 12 years.

It is this surge in nominal auto debt as well as the unprecedented spike in new auto loan rates, that we believe has finally pushed the US car sector to the infamous Wile Coyote point of no return.

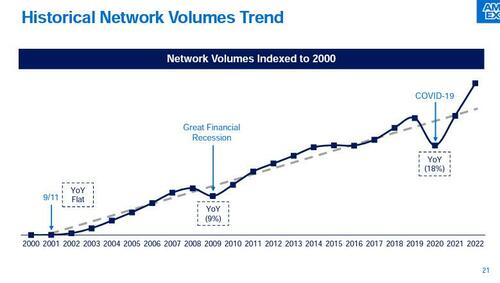

But first lets back up a bit. Recall, on Friday American Express reported blowout earnings, and forecast that revenue and earnings for 2023 will surge well above what analysts estimated after the company saw customer spending on its cards soar to a record in the final three months of the year, a time when the US economy was rapidly sliding into contraction.

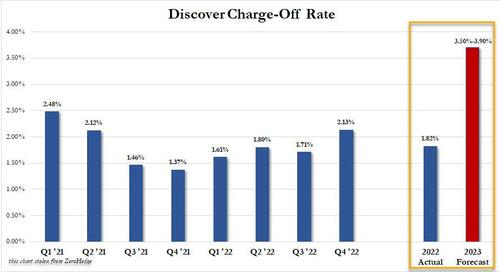

This is hardly a shock: targeting mostly the wealthiest tier of U.S. society, the future is bright for AmEx and its customers who – let’s face it – are not seeing a huge hit to their standard of living as a result of soaring prices and interest rates. It is everyone else that is getting hit hard, and it is everyone else that is using cards like Capital One and Discover (which target FICO score about 40-60 lower than AmEx). And readers will recall that it was Discover which two weeks reported that its projected charge off rate for 2023 would more than double from its current 1.82% to as much as 3.90%!

The news hit the stock like a lead balloon, and sparked renewed fears that the bottom and middle-classes are already in recession.

Then again, for those keeping a tab on the latest development in the US car market – where the bulk of consumers use Discover, not AmEx – that’s not exactly a shock.

Consider the following: as we first reported a month ago, a soaring number of consumers are falling behind on their car payments – a trend which will only accelerate – in a sign of the strain soaring car prices and prolonged inflation are having on household budgets.

Citing a NBC report, we reported that whereas repossessions tumbled at the start of the pandemic when Americans got a boost from stimulus checks and lenders were more willing to accommodate those behind on their payments, in recent months, the number of people behind on their car payments has been approaching prepandemic levels, and for the lowest-income consumers, the rate of loan defaults is now exceeding where it was in 2019, according to a recent report from Fitch.

Fast forward to today, when a newer report from Fitch has laid out an even more startling milestone: more Americans are falling behind on their car payments than during the financial crisis. As Bloomberg first observed after skimming the Fitch note, in December the percentage of subprime auto borrowers who were at least 60 days late on their bills rose to 5.67%, up from a seven-year low of 2.58% in April 2021. That compares to 5.04% in January 2009, the peak during the Great Recession, and just a few weeks before the Fed was about to start QE1.