by Peter Schiff, Schiff Gold:

lease note: the CoTs report was published 12/02/2022 for the period ending 11/29/2022. “Managed Money” and “Hedge Funds” are used interchangeably.

Gold

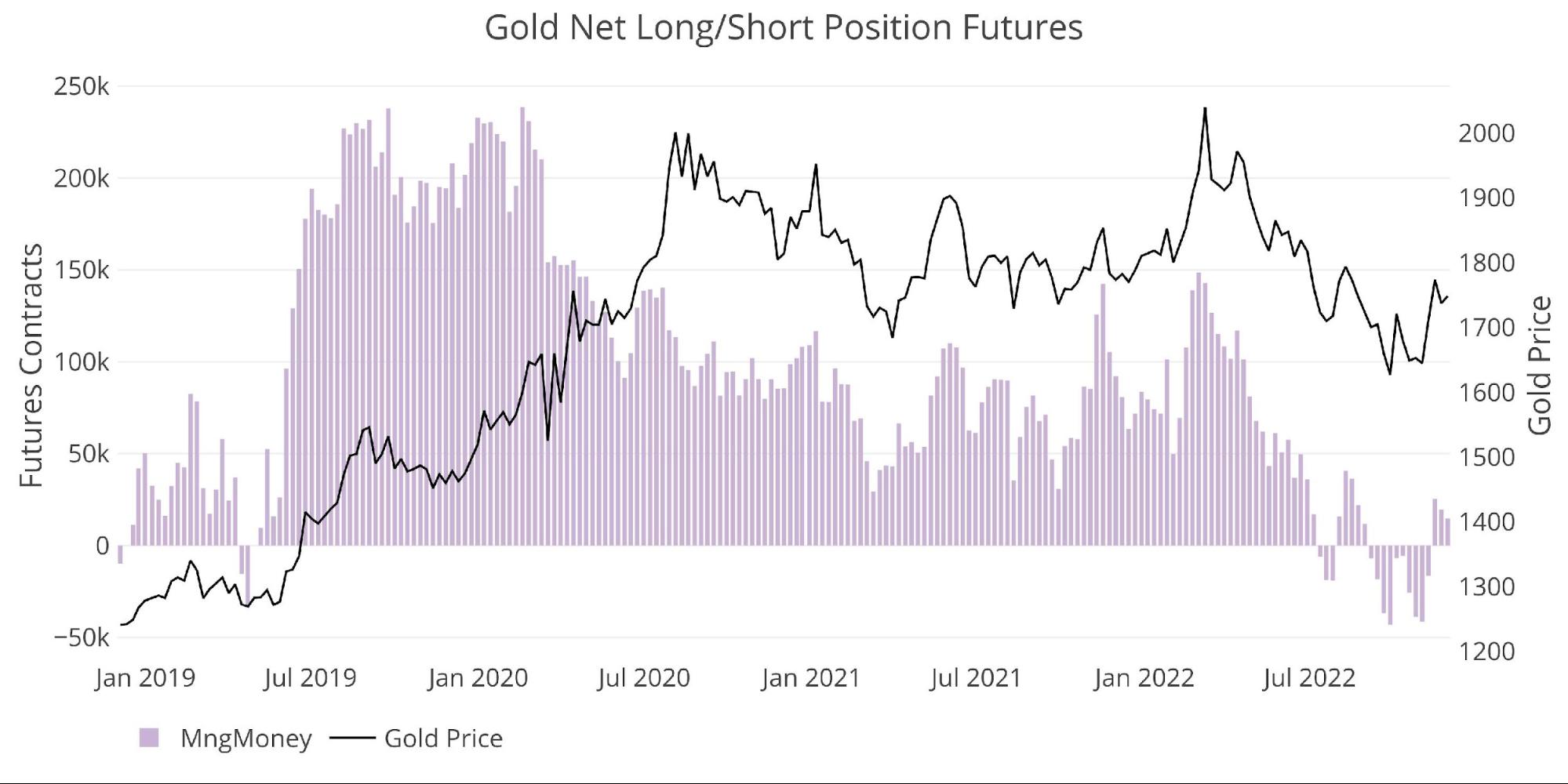

On November 15th, Managed Money reversed back to a net long position of 25k contracts after spending 4 weeks net short. Since then, net longs have fallen some in the last two weeks to reach 14k in the most recent reporting period.

The reporting period occurred before the soft Powell pivot earlier this week which prompted a major push up in the price of gold to above $1800. It’s very likely that the COTs report next week will show a greater net long position in gold.

TRUTH LIVES on at https://sgtreport.tv/

Figure: 1 Net Position by Holder

As shown in the chart below the Managed Money group continues to have complete control over this market, maintaining a correlation of price to a net position of 0.95 for 2022.

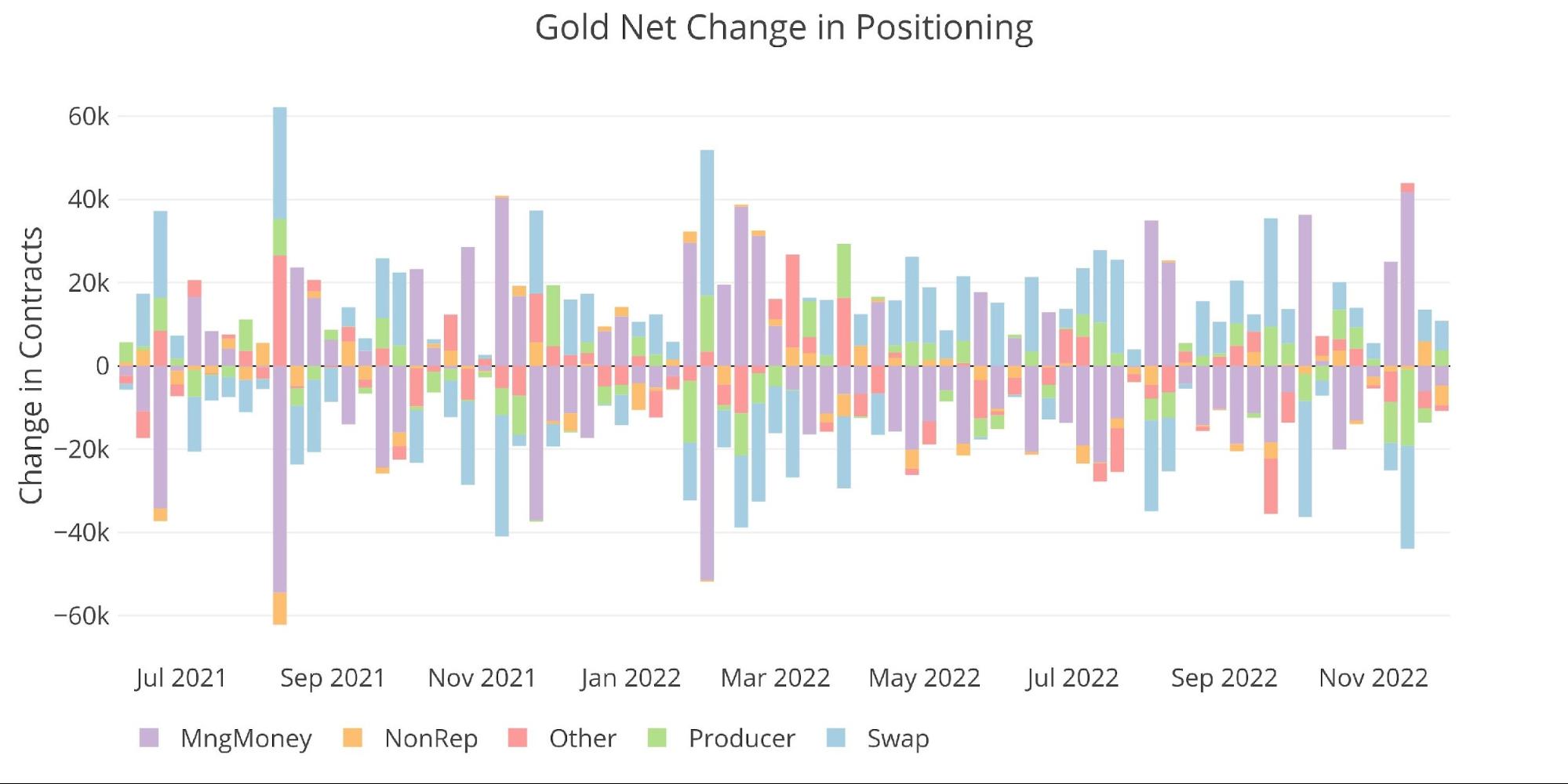

Figure: 2 Managed Money Net Position

Weak Hands at Work

The chart below shows the weekly data. The report last month highlighted the extreme selling of gold contracts by Managed Money, noting that only 8 of the previous 26 weeks had been net adds. Given the last two weeks shown below, it seems Managed Money is still a little hesitant to jump fully onto the bull side of this market.

Figure: 3 Silver 50/200 DMA

The table below has detailed positioning information. A few things to highlight:

-

- Over the month, Managed Money change was driven on the long and short side

-

- Gross Longs increased 22% while Gross Shorts decreased 34%, getting back below 100k

-

- Over the last year, Gross Shorts are still larger by 61.5%

- Producers were on the other side of this trade, reducing Gross Longs by 32.6% and increasing Gross Shorts by 71.4%

- Over the month, Managed Money change was driven on the long and short side

One more thing to note is that every participant has reduced their net positioning significantly over the last year, ranging from 29% to 84%. This shows an overall waning interest in the gold market as there is simply less aggregate open interest outstanding.