by Peter Schiff, Schiff Gold:

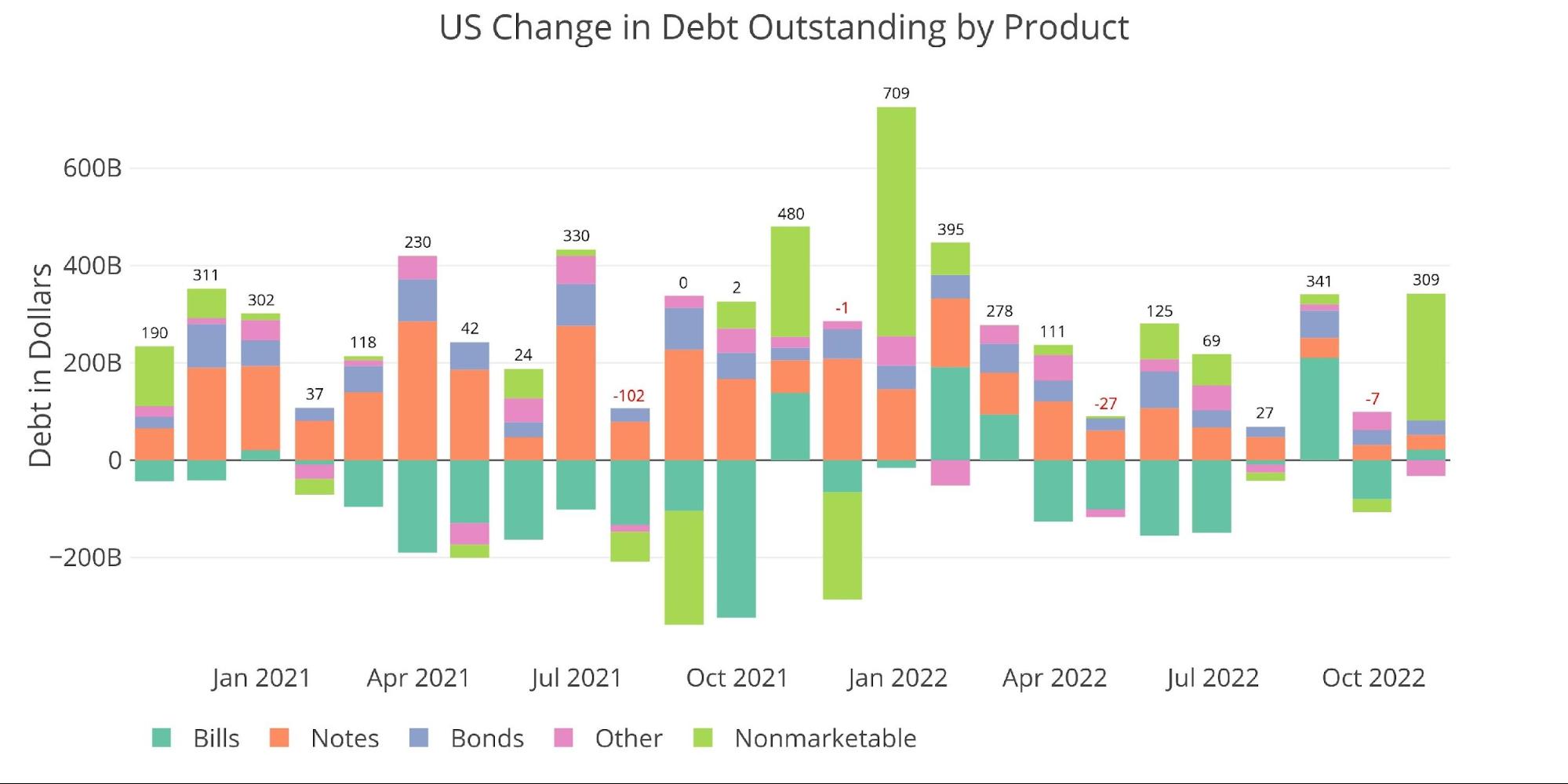

The Treasury added $309B in new debt during October, but $260B of it was Non-Marketable debt. The Non-Marketable debt was focused on Medical Insurance Trust Fund ($166B), DoD Retirement Fund ($26B), Child Enrollment Contingency Fund ($18B), and Federal Hospital Insurance Trust Fund ($14B).

The increase in Non-Marketable debt is likely in preparation for the debt ceiling debate. The Treasury did the same thing last October, increasing Non-Marketable debt by $226B.

TRUTH LIVES on at https://sgtreport.tv/

Note: Non-Marketable consists almost entirely of debt the government owes to itself (e.g., debt owed to Social Security or public retirement)

Figure: 1 Month Over Month change in Debt

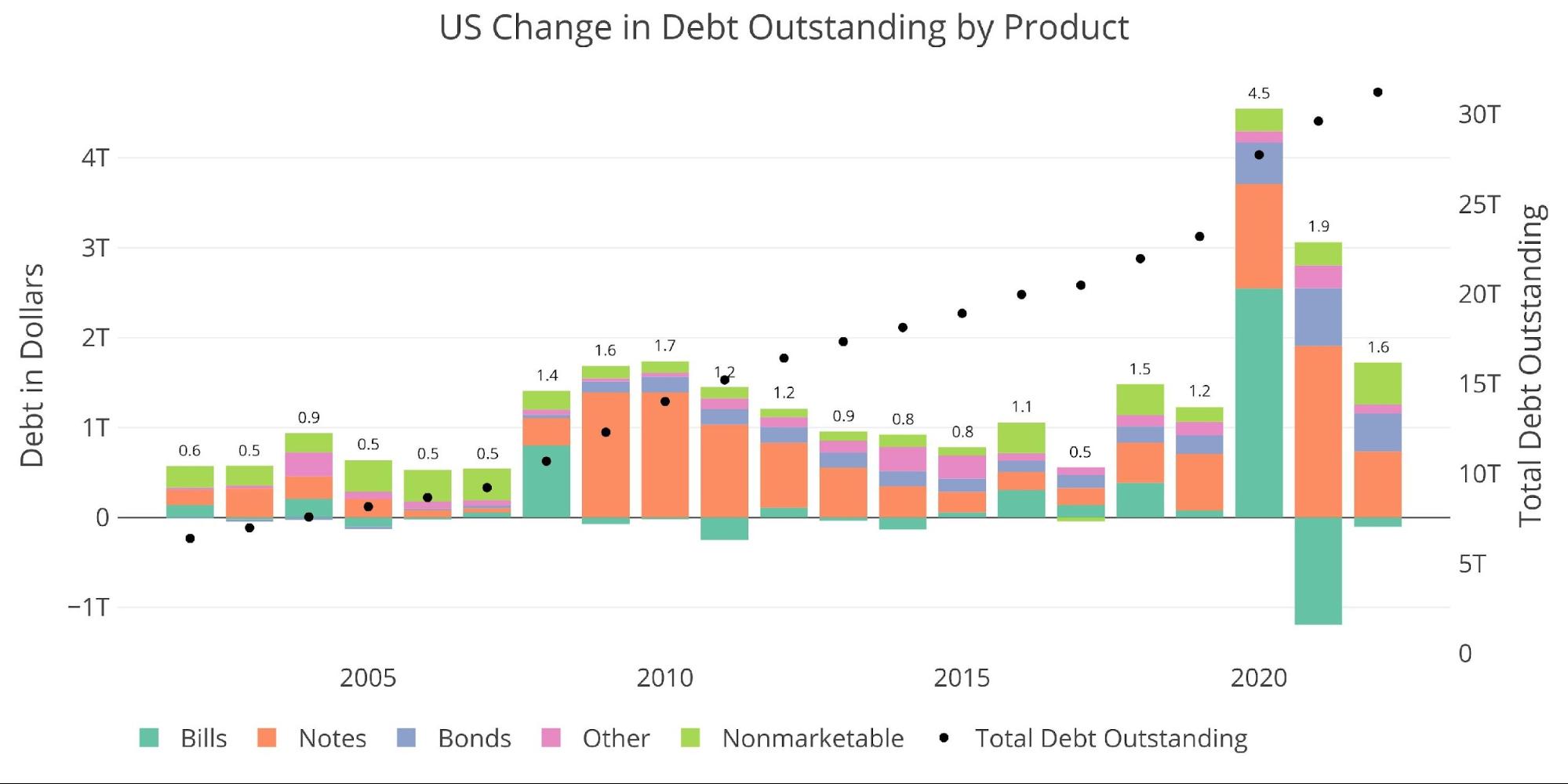

YTD the Treasury has added $1.6T in new debt in 2022 despite record-high tax revenues. Before Covid, only 2010 had higher debt issuance and that was for the entire calendar year. With two months left in 2022 and $200B left before hitting the debt ceiling, there is no doubt this year would have set a record before the Covid debt splurge.

Figure: 2 Year Over Year change in Debt

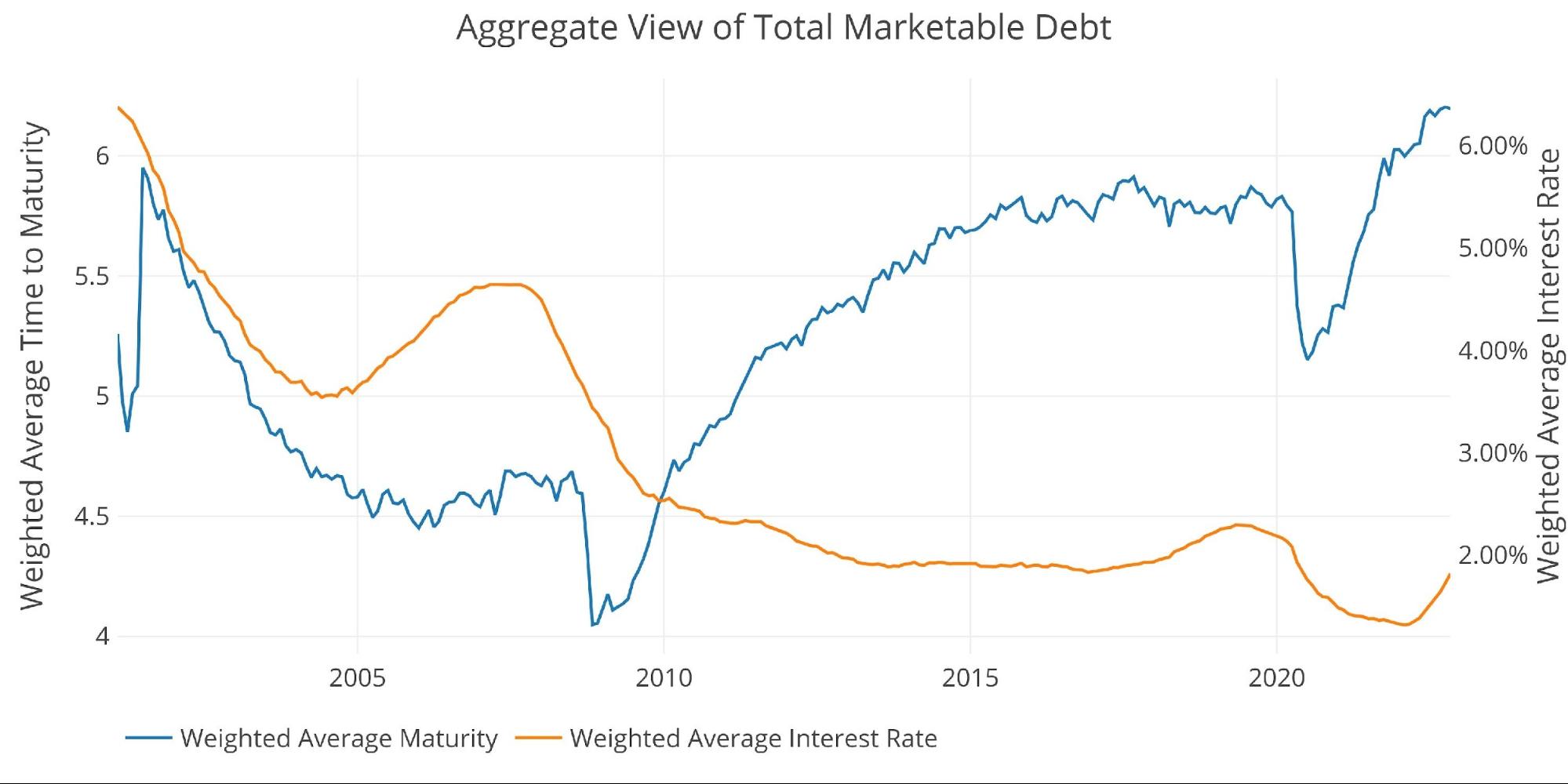

The recent conversion of short-term debt to long-term debt can be seen below as the Treasury has extended the average maturity of the debt to record highs. Current average maturity has stabilized at around 6.2 years up from 5.8 years before Covid.

Despite the long maturity of the debt, the weighted average interest on the debt continues to climb rapidly, moving up a full 10bps in the last month alone from 1.72% to 1.82%, and 18bps from August.

Figure: 3 Weighted Averages

The Treasury must know the Fed pivot will come, otherwise, their debt load becomes completely unsustainable!

The chart below shows the increase in interest cost so far, but it also calculates the impact on interest cost if the Fed sticks to its current plan. The chart models out interest rates at 4.5% by year-end, reaching 5.5% next September and then slowly coming back down in 2025.

The impact of higher rates is already taking its toll, but it gets significantly worse in the months ahead. The chart below estimates interest in excess of $750B by December next year and approaching $1T by the end of 2025.

Please note: for simplicity, it assumes the same (conservative) level of interest rate for all securities. It also only looks at Marketable debt and assumes $1T a year in new debt.