from ZeroHedge:

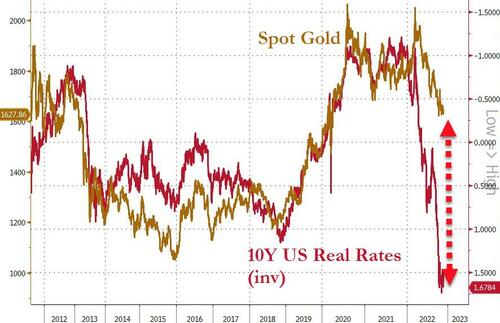

As The Fed has tightened monetary policy at its most aggressive pace in over 40 years, real rates in the US have soared (back into strong positive territory). Historically, that has reduced demand for gold (zero carry) but as the chart below, gold – while notably off its highs – has not cratered as much as some might have expected…

“With that weight of selling, I was a bit surprised gold wasn’t weaker,” said Ross Norman, chief executive officer of Metals Daily, an information portal focusing on precious metals.

TRUTH LIVES on at https://sgtreport.tv/

But, thanks to a normally dry research report from The World Gold Council, perhaps we know why gold has not fallen as much…

First, as we noted recently, despite the recent price slide in paper precious metals markets, physical demand (and prices) remain extremely high…

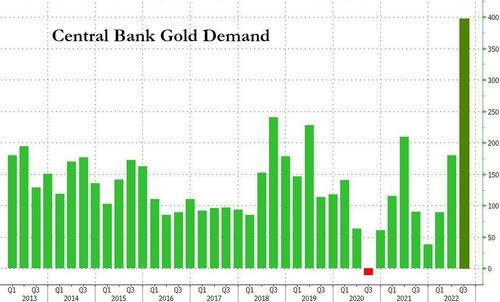

But, as we detailed earlier today, central banks bought 399 tons of bullion in the third quarter, almost double the previous record, according to the World Gold Council.

The tricky thing is though, as Bloomberg reports, just under a quarter went to publicly identified institutions, stoking speculation about who the mystery buyers were that waved in the other 300 tonnes of gold in Q3?

While most central banks inform the International Monetary Fund when they buy gold to supplement their foreign exchange coffers, others are more secretive.

Few have the capacity to undertake the third-quarter buying spree, enough to soften the blow from investors selling bullion as the Federal Reserve hiked interest rates.

Here are some possibilities as to who these mysterious bullion whales could be… (via Bloomberg)

China

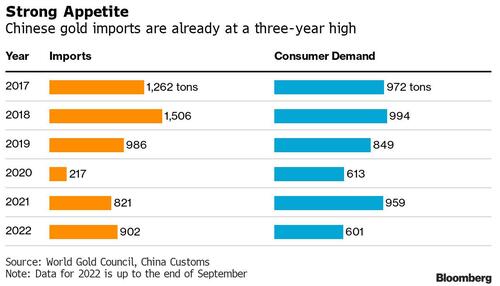

The world’s No. 2 economy rarely discloses how much gold its central bank is buying. In 2015, the People’s Bank of China revealed a nearly 600-ton jump in its bullion reserves, shocking market watchers after six years of silence.

The country hasn’t reported any change in its gold hoard since 2019, fueling speculation it may have been buying under the radar.

Trade data show the country has been taking in vast amounts of bullion. China has imported 902 tons of gold so far this year, already surpassing last year’s total. That’s on top of the more than 300 tons the country’s mines typically produce each year.

And while domestic demand has been strong, with citizens buying some 601 tons through the third quarter, it’s on track to fall short of 2021 levels. Earlier in the year, Covid-19 lockdowns hampered purchases of jewelry and bullion in one of the world’s top consumers.