from ZeroHedge:

One month ago, weeks before the crypto sector was shaken by the crushing FTX bankrun which led to a quick and painful bankruptcy, and revealed that one of the world’s biggest crypto exchanges and its “JPMorgan-esque” owner were nothing but hollow shells of fraud, another bank was suffering from a far bigger bank run.

TRUTH LIVES on at https://sgtreport.tv/

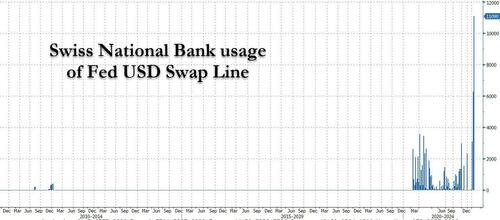

Readers will recall that in mid-October we reported that the Fed was quietly wiring increasingly greater dollar amounts to the Swiss National Bank – which eventually peaked at around $11 billion weekly – which in turn was then using these dollar swap lines to plug USD funding holes within one or more Swiss commercial banks.

One didn’t need to be a rocket surgeon to figure out that the bank in question was Credit Suisse, which had seen its stock tumble amid a relentless barrage of scandals, corporate mistakes and the occasional fraud (that we know of), and which we said was likely suffering from a painful behind-the-scenes bank run.

Fast forward one month, when this morning the 2nd largest Swiss bank confirmed our worst-case speculation, admitting that it had just gone through a staggering bank run in which clients pulled as much as 84 billion Swiss francs, or $88.3 billion, of their money from the bank during the first few weeks of the quarter, underlining ongoing concerns over the bank’s restructuring efforts after years of scandals.

Of course, as FTX learned the hard way, bank runs don’t have a happy ending, and the Zurich-based bank warned on Wednesday that it will face a loss of up to 1.5 billion Swiss francs ($1.6 billion) for the three final months of the year, in large part as a result of the decline in wealth and asset management client funds from the start of October to Nov. 11. That, according to Bloomberg, is the worst exodus since the financial crisis.

The outflows were especially acute at the key wealth management unit, where they amounted to 10% of assets under management. While they have been “reduced substantially from the elevated levels of the first two weeks of October 2022,” they have yet to reverse, the bank said.

This means that just as we expected, the massive dollar swap lines were being used by the SNB to provide Credit Suisse with much needed, critical funding; had the funds not arrived, Credit Suisse would likely have liquidated!

The client withdrawals contrast with inflows at rival wealth managers in recent months. AT UBS Group AG, investors added more than $17 billion to the wealth management unit in the third quarter. Julius Baer Group Ltd. said on Monday that it saw a “clear improvement” in new money flows since the end of June, with wealthy clients adding a net 4.1 billion francs in the four months through October.

“The massive net outflows in Wealth Management, CS’s core business alongside the Swiss Bank, are deeply concerning — even more so as they have not yet reversed,” said Andreas Venditti, banking analyst at Bank Vontobel AG in Zurich. “Credit Suisse needs to restore trust as fast as possible – but that is easier said than done.”

Analysts at JPMorgan Chase & Co. and Jefferies said the wealth-management outflows were much worse than expected, and warned that bank wasn’t out of the woods. Ethos Foundation, a proxy advisor, said more steps may be needed to restore investor confidence than the bank has so far outlined.

“Cutting cost is one thing but growing the business is another one,” Vincent Kaufmann, Chief Executive Officer of Ethos, said on Bloomberg TV. “Maybe they can do both, but it remains to be seen.”

Besides the massive bank run which has drained the bank’s capital, the Zurich-based bank said it expects losses in both the wealth management division and its investment banking unit due to “subdued activity, market conditions, continued outflows of customer assets and the sale of non-core businesses.