by Tuomas Malinen, The Epoch Times:

I have had a series of conversations lately on how did we, the world, get to this point? I think that it’s a valid question, considering how well things were in the 1990s after the Soviet Union had collapsed.

The really interesting follow-up question is: Has this deterioration been a series of mere random events, or have we been somehow guided to this point?

I think there have been two major “game changers”: the 9/11 terrorist strikes and the global financial crisis of 2008–09 (GFC). If you really consider the aftermath of these events, it’s rather clear that we never really returned to the status quo after either.

TRUTH LIVES on at https://sgtreport.tv/

The 9/11 terrorist attacks started an escalating series of conflicts around the world, which have now turned into a Russian–Ukrainian war. I have my own worries that the war in Ukraine is, in veritate, not proceeding as presented in the Western media, which is likely to rather strongly follow the Ukrainian propaganda. As the late California Republican Senator Hiram Johnson once said, in 1918: “The first casualty when war comes is truth.” I have detailed my doubts in my newsletter.

The global financial crisis, on the other hand, changed our economic landscape, rather permanently, which is now converging with the war-related costs to create an extremely precarious economic situation.

If someone had told me in the early 2000s that in in the 2010s, central banks, led by the Federal Reserve, would be buying hundreds of billions’ worth of government bonds each month, I would have wished him/her a nice trip to an asylum. The mere idea would have sounded so preposterous at the time. But after the financial crisis—there we were.

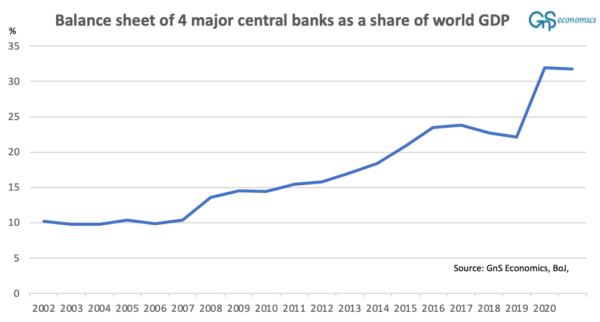

The Federal Reserve started the asset purchases on Nov. 25, 2008, and slowly but surely all major central banks followed. It became the biggest central bank money-conjuring operation in history!

In 2020, the size of the combined balance sheet of the four largest central banks—the Bank of Japan, the Federal Reserve, the European Central Bank, and the People’s Bank of China—reached an insane 32 percent of the gross domestic product of the world.

Like I have been detailing, this had some serious repercussions for the financial markets and the real economy (see, e.g., this, this and this).

However, the main point to understand is that if you artificially and vastly increase the amount of money in circulation, it will increase prices. This may occur with a lag, meaning that money may increase considerably without causing any noticeable increase in the price level. Then a supply-side shock, like an oil shock, hits and prices start to rise.

Combined with the greatly increased money in circulation, this shock, if it persists, will put in motion a process whereby prices increase but the demand will not come down, because it is supported by the vast amounts of money slushing around in the economy. When a sustained demand meets ailing supply, prices naturally continue rising. Then consumers will notice that the purchasing power of their wages is declining, and they start to demand higher salaries. At this point, fast inflation becomes self-sustaining. This process can be further supported by government subsidies and support.