by Peter Schiff, Schiff Gold:

Physical metal has continued to drain from COMEX vaults. This is particularly true for silver, which now has 17.4 paper ounces for every registered ounce.

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Warrant assigned and can be used for Comex delivery, Eligible = No warrant attached – owner has not made it available for delivery.

TRUTH LIVES on at https://sgtreport.tv/

CURRENT TRENDS

Gold

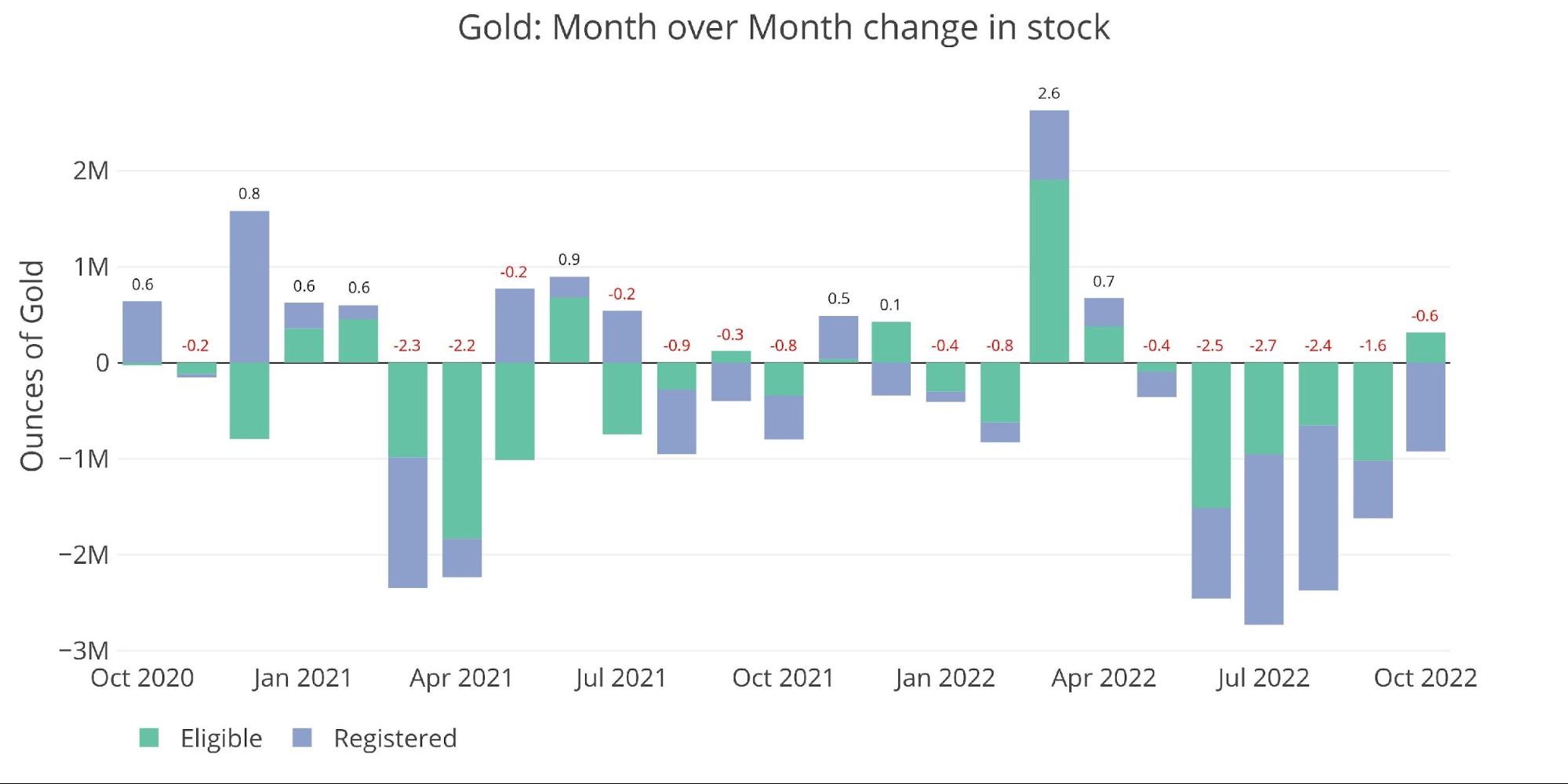

The relentless fall in gold inventories continued again in October. While the overall vault decrease has slowed somewhat, the fall in Registered (925k) has already exceeded the total in September (600k) and will more than likely eclipse June (942k). Registered means the metal available for delivery, so this is an important trend to watch.

Figure: 1 Recent Monthly Stock Change

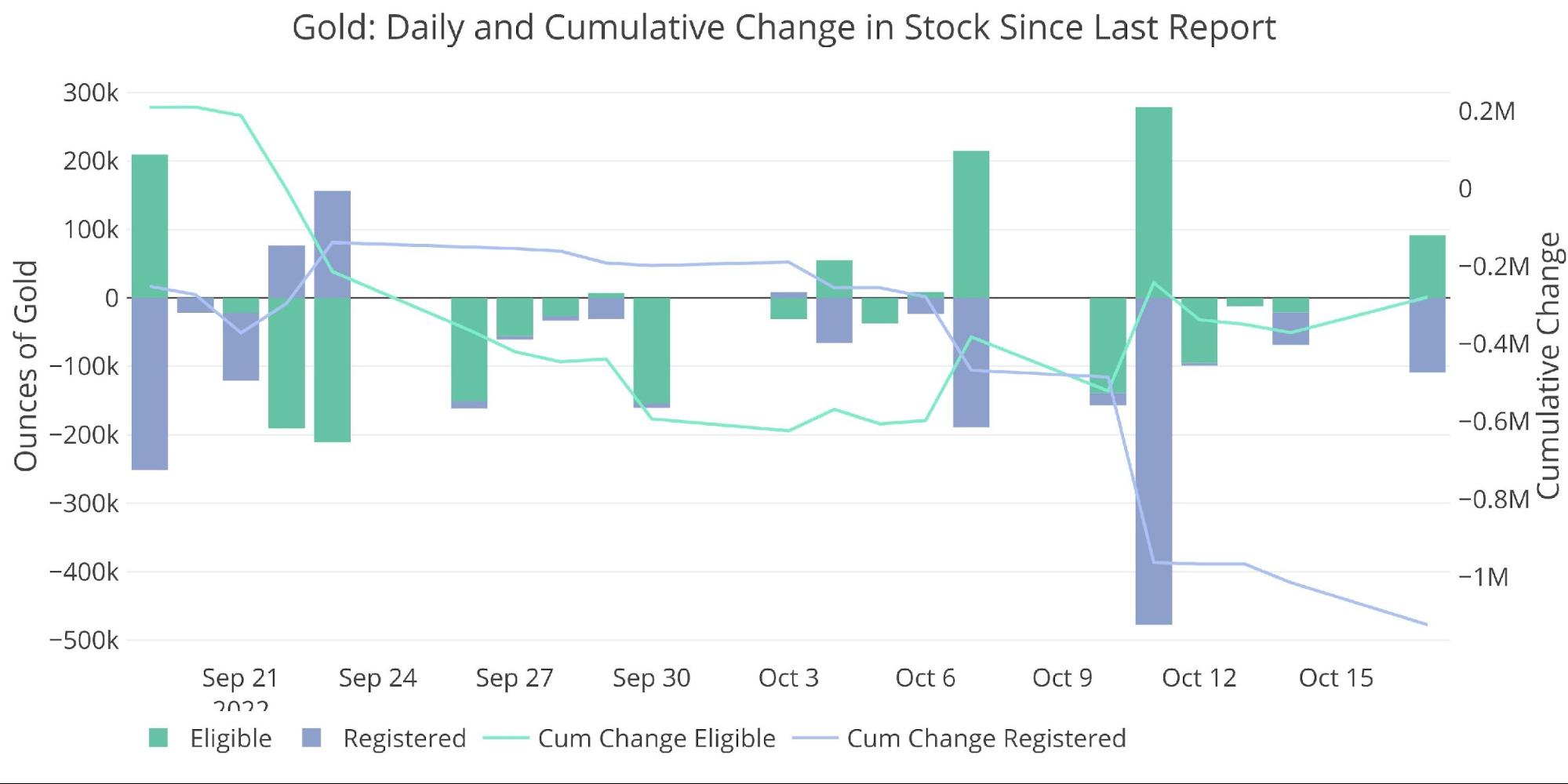

The daily vault moves can be seen below. As shown, hardly a day goes by without a significant move at this point.

Figure: 2 Recent Monthly Stock Change

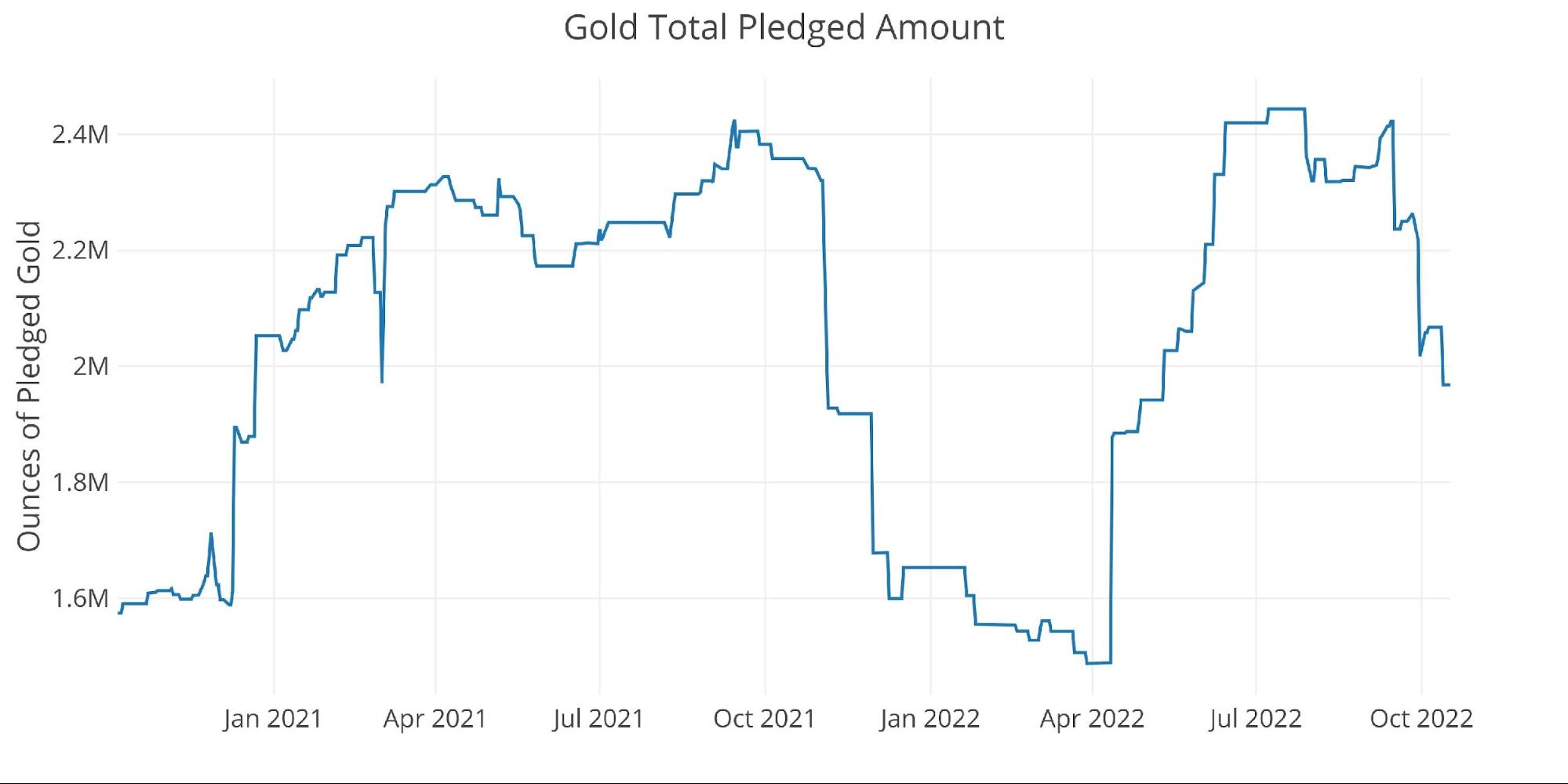

The current fall in Registered is also impacting the Pledged category. Pledged is a subset of Registered but is actually not available for delivery because it has been pledged as collateral. The biggest falls have come from Brinks, HSBC, and Manfra who have reduced Pledged by a combined 464k ounces over the last month.

Figure: 3 Gold Pledged Holdings

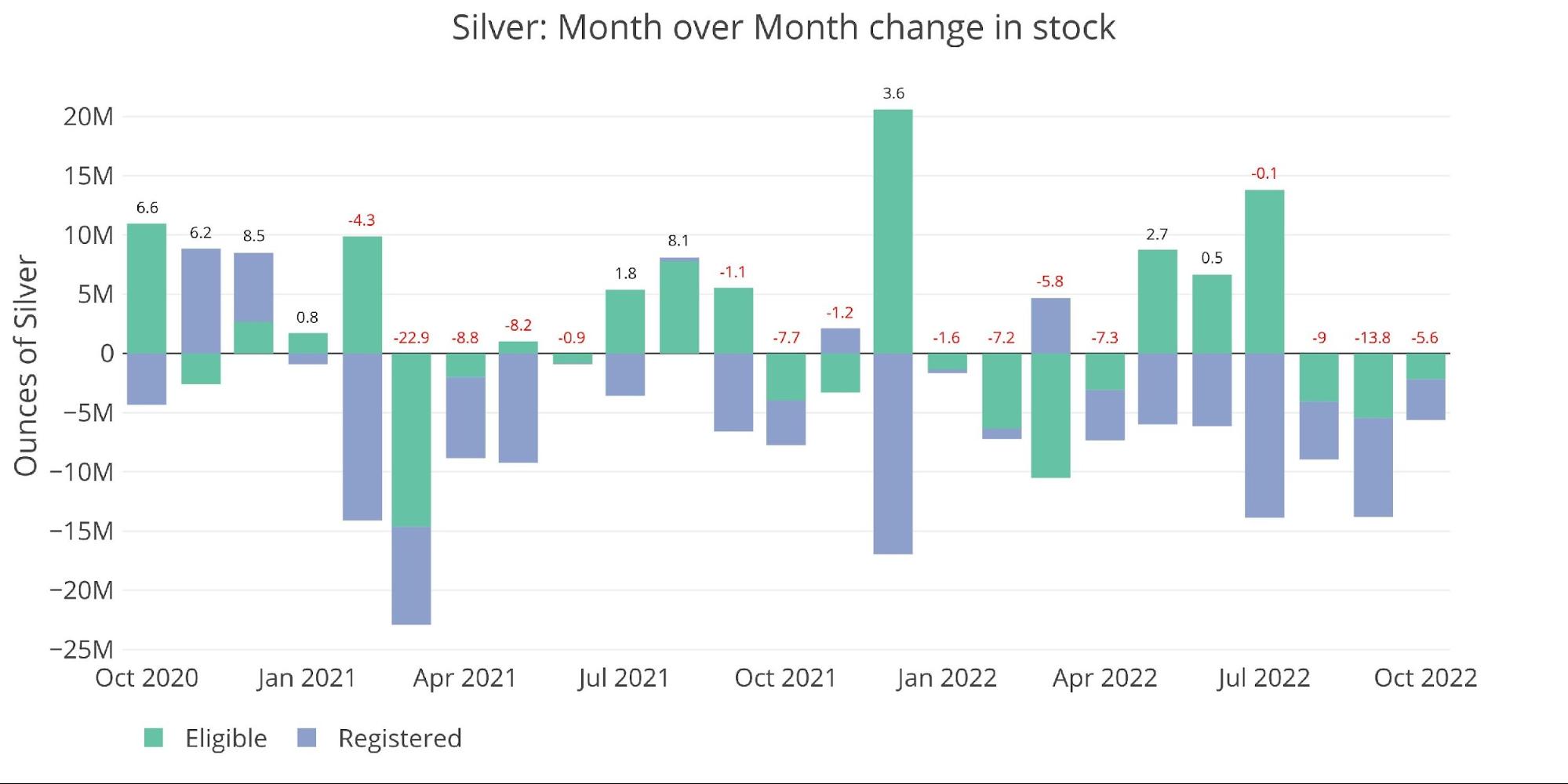

Silver

The story in silver is in the Registered category which just fell below 40M ounces for the first time since October 2017 (see Figure 7). This means there are less than 8,000 contracts of Registered metal available for delivery. The next major silver month is December. For reference, last December saw 9.2k contracts delivered with 10.5k standing for delivery as recently as March.

Figure: 4 Recent Monthly Stock Change

There is not enough Registered silver to handle a large delivery month. This is probably why silver is seeing the smallest delivery month in years. There must be cash settlement going on behind the scenes. This is further evidenced by Bank house accounts which have completely left the delivery market! So far, bank house accounts have delivered 4 total contracts of silver. For reference, in September they were responsible for a total of 8,500 contracts (combined long and short) and 750 contracts in August (the last minor delivery month). This can be seen in the chart below. The bar for October is not even visible!

Why would banks immediately cease activity? It could very well be that supplies are so tight that they have no other option.

Figure: 5 House Account Activity

Another strange occurrence was the flat line in Registered decline that just ended. For months, Registered silver saw significant declines almost daily. There might have been 1-2 days with little activity but then the withdrawals would resume.

All of a sudden, right before Registered dipped below 40M in total ounces, the declines stopped. For 7 business days, the ounces in Registered barely moved until yesterday’s report showed that Friday saw 1.3M ounces leave.