by Peter Schiff, Schiff Gold:

The student loan forgiveness program recently announced by President Joe Biden stirred up quite the political brouhaha. Progressives praised Biden for helping students burdened by overwhelming student loan debt. Conservatives decried it as an unfair giveaway. But as with most issues, the popular political debate misses the bigger picture.

TRUTH LIVES on at https://sgtreport.tv/

The student loan crisis was primarily a problem of the federal government’s own creation. And no matter what you think about the forgiveness program, it fails to address the root of the problem.

In a sense, the student loan crisis was a boom-bust cycle in a microcosm. Economics writer J.R. MacLeod argues that the crisis was the fault of the entire bureaucratic economic-political system.

The following article was originally published by the Mises Wire. The opinions expressed are those of the author and do not necessarily reflect those of SchiffGold or Peter Schiff.

In a market economy, prices are determined by supply and demand: how much of a quantity is being offered and how much value people place on that good relative to other goods. However, with great government power comes the potential for great government irresponsibility: artificially lowering prices for some either through outright money printing or by taxing some to subsidize others.

In the Austrian business cycle theory (hereafter ABCT), lowering prices artificially causes serious trouble in the economy, as the government is directing excessive resources into an area unsupported by accompanying supply and demand. Thus, when the monetary spigot is turned off, these areas are revealed to be insolvent; they were kept afloat only by government-created conditions, causing malinvestment.

Meanwhile, other sectors of the economy were neglected and starved of resources due to the favorable position created by the government elsewhere. A boom turns to bust. The economy experiences a downturn as businesses are liquidated and capital positions are reformed.

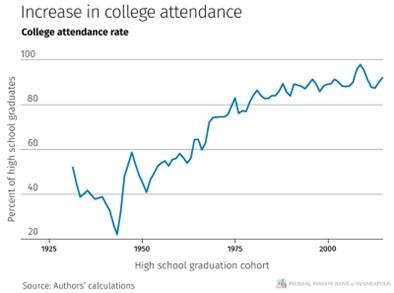

This phenomenon can be observed in the modern structure of student loans. In 2010, the US federal government took responsibility for student loans outright, but before then, there had still been significant government participation in this market. Before 2010, student loans were still guaranteed by the federal government, and the government even participated in direct lending alongside banks. Of course, when you subsidize something, you get more of it, and the proportion of young people going to college has grown steadily. We can call this a boom.

Under market conditions, banks would have to ensure enough loans are repaid to cover their costs and make a profit. Otherwise, they would go out of business. This would lead to students’ plans being properly scrutinized. If the banks predicted a student’s college and career plans would leave the student unable to repay the loan, they would tell the student to take a different major, or go to a more affordable college, or perhaps even to forego college altogether and pursue an alternative path. While progressives would consider this mean, ultimately it would protect young people from carrying large debts that they are unable to repay and protect the general taxpayer from having to pick up the slack.

Under conditions of government intervention, the opposite incentives manifest. An obscure game of musical chairs where it is uncertain which income bracket and which generation will foot the bill, and even whether the shortfall will be made up by printing money or by taxation, prevails. However, we do know the loans come at the general public’s expense, and that for the banks, the students, and the universities themselves, a situation of easy money prevails.

Without the profit motive, banks apply less discretion in granting loans, universities lower entrance requirements, and potential students reevaluate their options in favor of college. Discipline is eroded, as the nebulous collective future taxpayer will be forced to underwrite the whole thing.

Many of these government loans constitute malinvestment; the students cannot secure a job that enables repayment. In a market transaction, we see a coincidence of wants. Both parties agree to the trade, and nobody else is forced to participate. With government student loans, artificial intervention against real market supply and demand guarantees a negative return, for which the taxpayers are forced, ultimately at gunpoint, to pay.