by Peter Schiff, Schiff Gold:

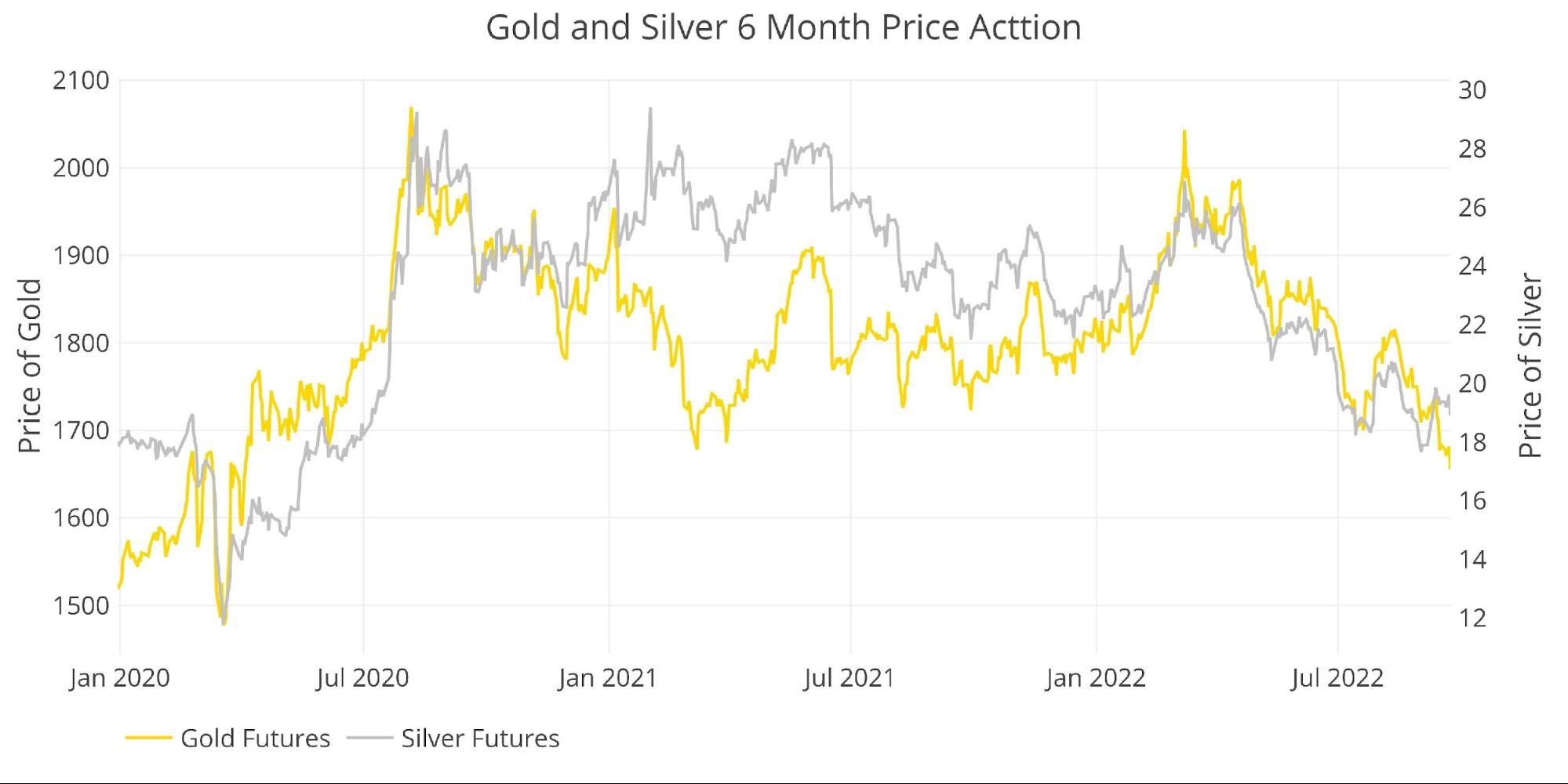

The price analysis last month titled Caution Warranted in the Short Term, highlighted the potential risk in gold and silver even after a rough July and early August. It concluded the path now is much less clear. Gold could be range bound again between $1750-$1800. Or, a hawkish Fed at the Jackson Hole summit could potentially crack $1750 and open up the door for new lows. The gold miners are definitely anticipating this!

TRUTH LIVES on at https://sgtreport.tv/

The hawkish Fed showed up in Jackson Hole and again on Wednesday sending the metals tumbling. After a brief short-covering rally late this week, gold found new lows Friday led by the miners. The market is now oversold which could lead to a short-term bounce. However, any rally is unlikely to gain momentum until a Fed pivot is clearly in view (or the physical market breaks). Luckily for the gold and silver bulls, the pivot will come into view sooner than anyone currently anticipates.

The Fed has talked tough and backed it up. However, they have likely already broken something and the data hasn’t shown it yet. They are moving so quickly that by the time the cracks show up in the data, it will be too late. The Fed will be dealing with an economy on the brink of disaster. Then what?

For now, the Fed has room to keep chugging along. The data looks okay, the Fed has stated they will accept a bumpy landing, and the market is selling off but not crashing. Thus, the metals continue to slide. So, what does the data show lies ahead?

Resistance and Support

Gold

Gold broke down below $1700 and is barely hanging onto $1650. The shorts smell blood and are pushing the longs to trigger stops. If it happens, the market could see the metal trade in the $1500s. $1750 is the new hard ceiling gold needs to break through. Until then, pressure is down.

Outlook: Bearish

Silver

Despite a rough Friday, silver has held up much better than gold. That being said, silver has been having trouble with $20, but real resistance lies at $22.

Outlook: Bearish until $22 is taken out

Figure: 1 Gold and Silver Price Action

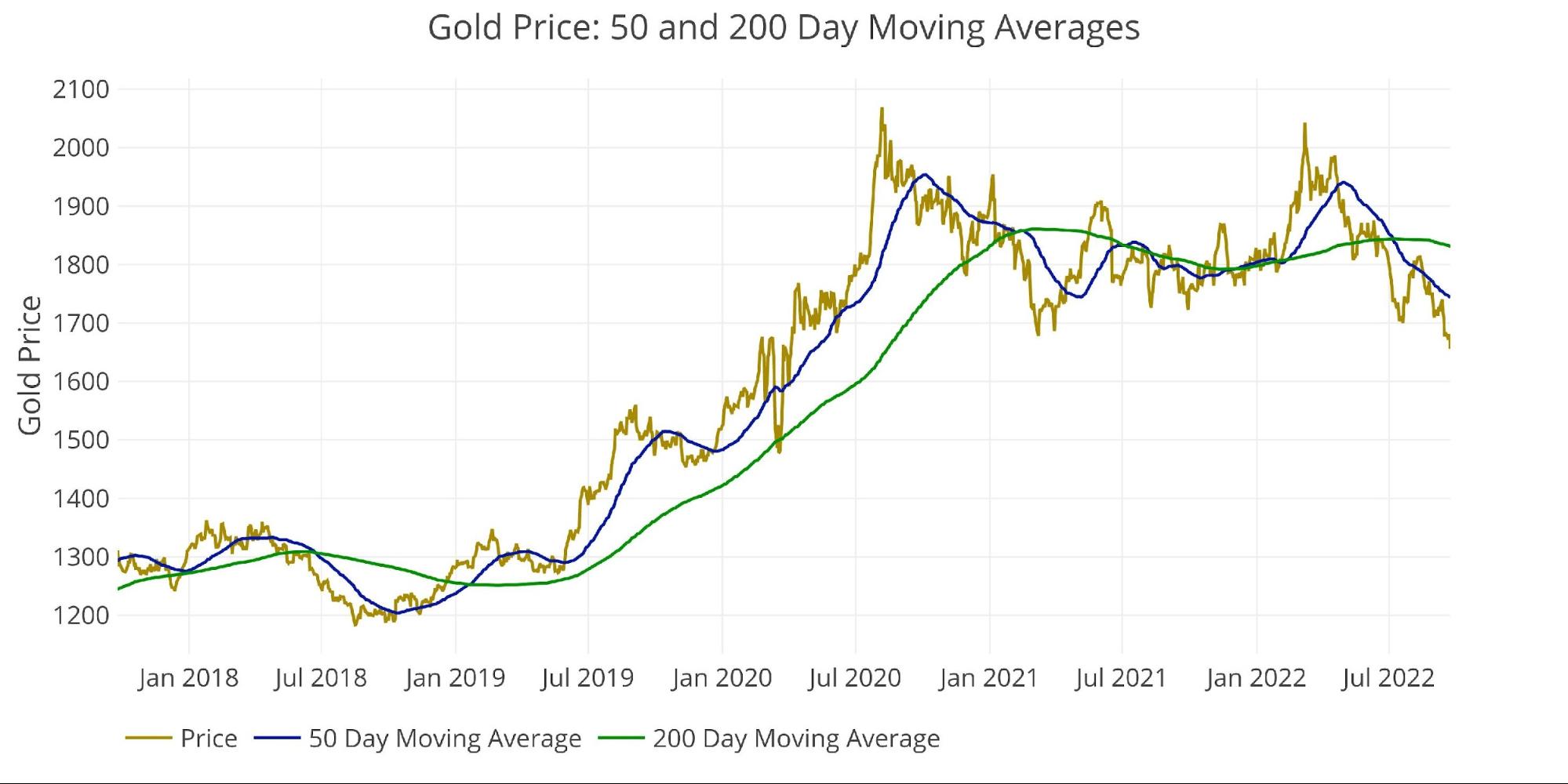

Daily Moving Averages (DMA)

Gold

It’s bearish that the 50 DMA ($1743) is well below the 200 DMA ($1831); however, the market rarely goes in one direction without a pause. Expect a short-term bounce. The bounce cannot be trusted until the current price ($1655) at least breaches the 50 DMA and more likely the 50 DMA needs to break the 200 DMA to confirm a new bullish trend.

Outlook: Bearish

Figure: 2 Gold 50/200 DMA

Silver

Silver is slightly different with the current price ($18.91) sitting just below the 50 DMA ($19.25). It had popped above it a few times this week but could not hold. The 200 DMA of $22.10 is still a bit further off.

Outlook: Looking for a trend change

Margin Rates and Open Interest

Gold

Open interest is at multi-year lows, and likely only increasing slightly in recent days due to shorts entering the market. This means there is ample dry powder on the sidelines to get behind a long move when it comes.

That being said, margin rates in gold are $5700 (3.45%) which is the lowest since March 2020. This has actually led to increased short positions as speculators look for leverage on their outlook.

The CFTC does not typically raise margin rates on the shorts (this could induce a short squeeze). The CFTC uses margin rates to cap any price advance. Thus, while there is cash on the sidelines to drive a long move, it will be restrained by the CFTC.