from ZeroHedge:

In today’s world of at times unparalleled idiocy at the top echelons of power, nobody can hold a candle to the government and central bank of Japan.

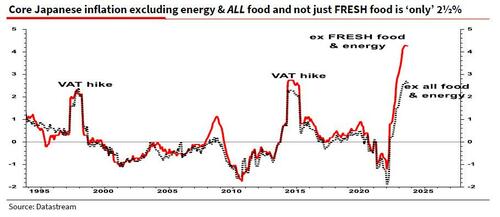

Consider this: as the BOJ injects billions of liquidity into its bond market every single to prevent a crash that could mark the end of Japanese civilization as we know it (for context, the BOJ owns more than half of all JGBs outstanding, blurring the lines between fiscal and monetary policy, and adding to financial instability risks; furthermore the size of the BOJ’s balance sheet – at almost $6.5 trillion – is the largest in the world in GDP terms, and substantially higher than the Fed’s or the ECB’s) Japan has seen the yen collapse at such a rapid pace that it would make banana republic currencies such as the Turkish Lira blush. And as the yen imploded, and historic inflation spread across the otherwise deflating Japan…