by Wolf Richter, Wolf Street:

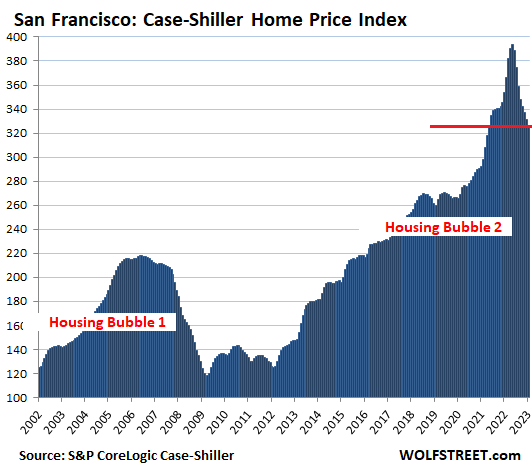

Double-digit drops from peak in San Francisco Bay Area, Seattle, San Diego, Phoenix, Las Vegas.

Double-digit drops from peak in San Francisco Bay Area, Seattle, San Diego, Phoenix, Las Vegas.

This time, it’s not an unemployment crisis that is taking down the housing market. The labor market is still tight with big pay increases – though the tech and social media segments have begun to wobble. But it’s mortgage rates that have reverted to the pre-QE normal levels of 6% to 7% amid CPI inflation in about the same range. And they’re clashing with home prices that had spiked maniacally under the Fed’s QE and interest rate repression.