from The Alex Jones Show:

TRUTH LIVES on at https://sgtreport.tv/

from The Alex Jones Show:

TRUTH LIVES on at https://sgtreport.tv/

by Brian C. Joondeph, American Thinker:

Summer is the season of warm and often hot weather. The Lovin Spoonful sang it clearly, “Hot town, summer in the city. Back of my neck getting dirty and gritty. Walking on the sidewalk, hotter than a match head.” Sly and the Family Stone also celebrated, “Hot Fun in the Summertime.”

We are now in the middle of summer, also known as the “dog days” which according to the Farmer’s Almanac, “Traditionally refers to a period of particularly hot and humid weather occurring during the summer months of July and August in the Northern Hemisphere.”

from The Epoch Times:

California reparations plans are moving forward, with separate proposals under consideration by the state Legislature and the city of San Francisco, but critics including a former San Francisco supervisor are raising alarms that the recommendations exceed budgetary limitations.

Established in May 2021 with the passage of Assembly Bill 3121, the California Reparations Task Force submitted its final recommendations to the Legislature on June 29, in the form of a 1,100-page report issuing guidance for apologies and calculations for determining cash payments.

by Michael Snyder, The Economic Collapse Blog:

Should we be surprised that we are witnessing so many failures all around us? After all, the mainstream media claims that the U.S. economy is doing just great. Of course the truth is that the economy is not in good shape at all. Those in positions of power have been desperately trying to prop up the system, but it continues to steadily fall apart. Earlier this year, we witnessed the second largest bank failure in U.S. history, the third largest bank failure in U.S. history, and the fourth largest bank failure in U.S. history. The Federal Reserve implemented extreme measures in an attempt to keep more banks from failing, but now another one has failed. On Friday, Heartland Tri-State Bank collapsed and the FDIC took control and arranged a sale…

from DollarVigilante:

TRUTH LIVES on at https://sgtreport.tv/

by Daniel Greenfield, FrontPage Mag:

The closed-door testimony by Devon Archer, Hunter’s closest ally and partner, confirmed some of what we knew.

As the House Oversight Committee notes, Devon Archer allegedly stated that “when Joe Biden was Vice President of the United States, he joined Hunter Biden’s dinners with his foreign business associates in person or by speakerphone over 20 times.”

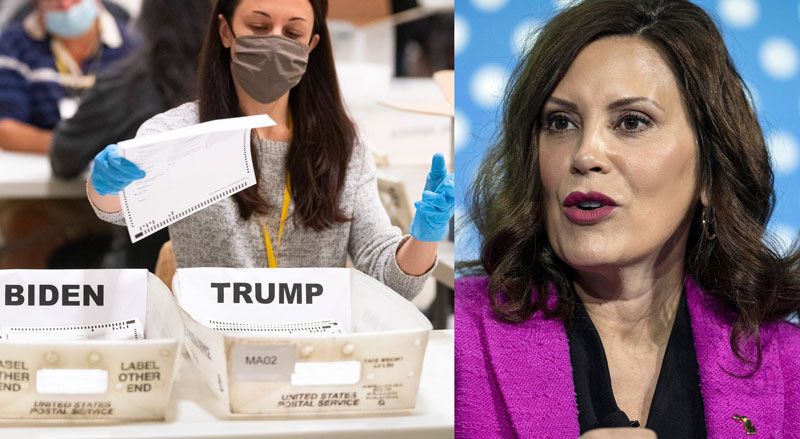

by Frank Bergman, Slay News:

Tens of thousands of illegal ballots have been found in Detroit, Michigan during an explosive criminal forensic study into the 2020 election results.

Specklin Forensics, a national expert in criminal forensics, completed an investigation into the 2020 election in Michigan and published a report on its findings.

The organization found further evidence of chronic, systemic voter fraud, according to the report.

by Leo Hohmann, Leo Hohmann:

Why can’t the neocons in Washington understand they are dealing, not with Saddam Hussein or Muammar Gaddafi, but with a nuclear superpower?

If the U.S./NATO-backed Ukrainian counter-offensive were to prove successful in retaking certain Russian territories, Russia would be forced to use nuclear weapons.

This was the message of Dmitry Medvedev, deputy chairman of the Russian Security Council.

by Jen Smith, Daily Mail:

Tafari drowned on Sunday while paddle boarding with another person

Tafari drowned on Sunday while paddle boarding with another person

The call came in to Edgartown Police Department at 7.46pm but in logs, the reason is blank

Martha’s Vineyard police left the reason for the 911 call reporting Obama private chef Tafari Campbell’s drowning blank in official logs from the night of the accident, DailyMail.com can reveal.

by Martin Armstrong, Armstrong Economics:

COMMENT: All of a sudden, El Niño is proof of global warming, just like the wildfires in Australia and California, as if these things never happened before. The sheep believe whatever the press tells them. That’s why you cannot stop the cycle, and 2032 is now not so far away.