by Chris Menahan, Information Liberation:

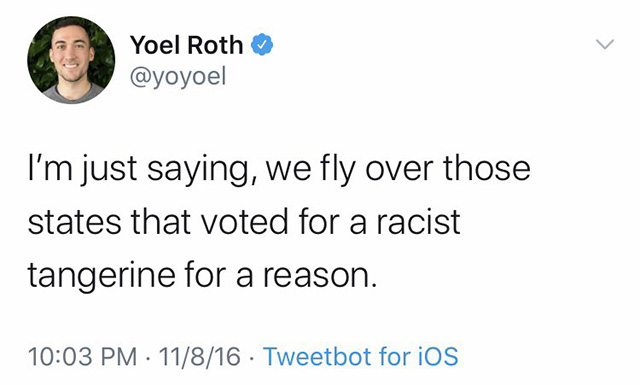

Yoel Roth, the far-left libtard Elon Musk had in charge of censoring users on Twitter, reportedly quit his job on Thursday.

Yoel Roth, the far-left libtard Elon Musk had in charge of censoring users on Twitter, reportedly quit his job on Thursday.

“Twitter’s head of safety and integrity, Yoel Roth, left the company Thursday, according to Twitter employees who spoke on the condition of anonymity because they were not authorized to speak to a reporter,” the Washington Post reports. “Roth had become the public face of Twitter’s content moderation policies in the days after Musk assumed ownership of the company.”

Official figures published by the UK Government confirm 1 in every 310 people who received a third dose of the Covid-19 injection in England by 31st December 2021, sadly died within 48 days.

Official figures published by the UK Government confirm 1 in every 310 people who received a third dose of the Covid-19 injection in England by 31st December 2021, sadly died within 48 days.