by Scott S. Powell, American Thinker:

America in the twenty-first century has been on an accelerating descent not unlike what befell ancient Rome. For some four centuries Rome’s Senate and constitution provided continuity which sustained the Roman Republic through various challenges. But in the end, what befell Rome from barbarian invasion, political corruption, and mobs that were manipulated and used by its Caesars, was a rampage against reason and freedom, leading to the Republic’s demise and transition to a centralized imperial authority under emperors.

Bill Clinton’s “lost” son has slammed his father for being a “sick psychopath” who has zero empathy for the son he abandoned.

Bill Clinton’s “lost” son has slammed his father for being a “sick psychopath” who has zero empathy for the son he abandoned. Independent French researchers discovered a significant increase in newborn deaths in France coinciding with the rollout of Beyfortus, a new respiratory syncytial virus shot for infants.

Independent French researchers discovered a significant increase in newborn deaths in France coinciding with the rollout of Beyfortus, a new respiratory syncytial virus shot for infants.

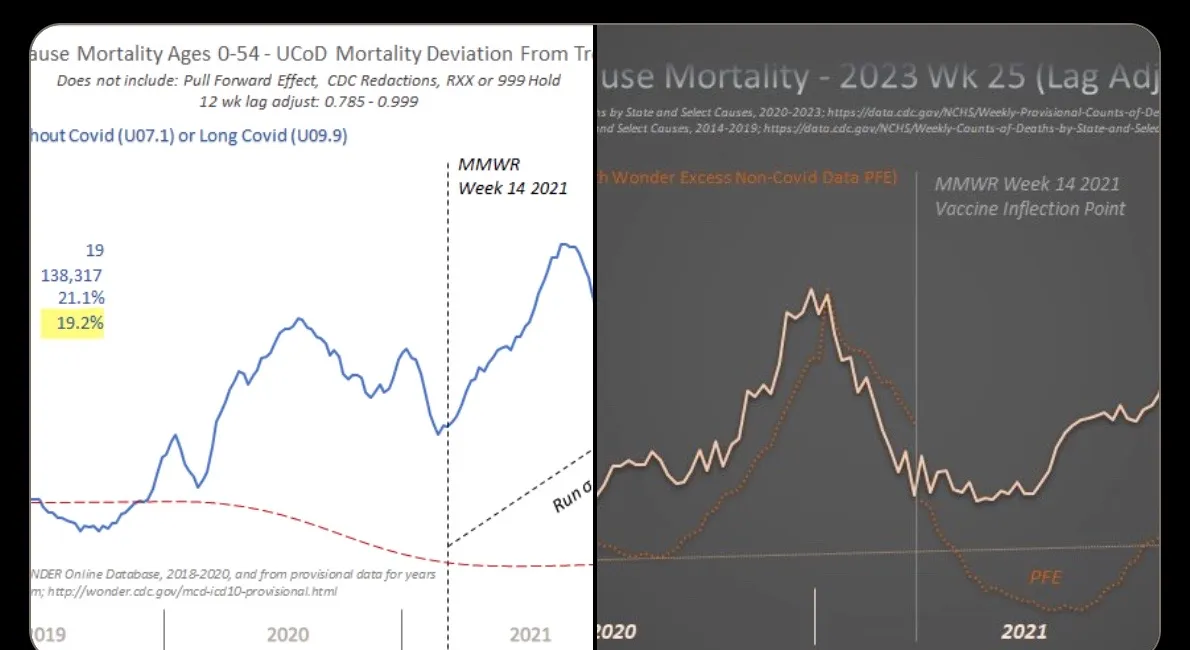

This Substack has previously covered the slow kill bioweapon death and disease adverse events…

This Substack has previously covered the slow kill bioweapon death and disease adverse events…

Chilling footage shows a group of masked neo-Nazis marching through historic black neighborhoods in Nashville, Tennessee on Saturday before raising their swastika flags at the State capitol.

Chilling footage shows a group of masked neo-Nazis marching through historic black neighborhoods in Nashville, Tennessee on Saturday before raising their swastika flags at the State capitol.