from ZeroHedge:

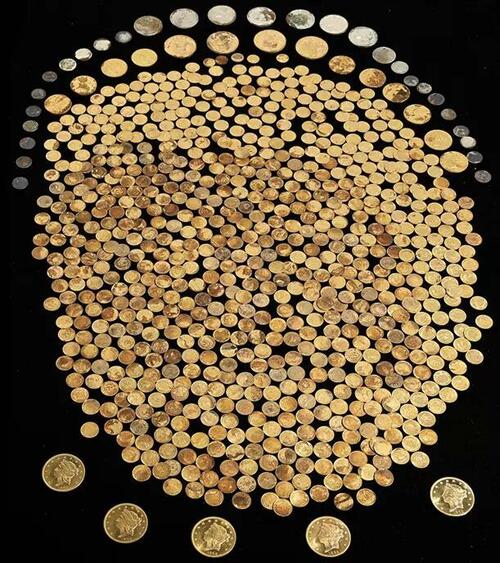

A Kentucky man has unearthed an astounding cache of Civil War-era gold coins from a cornfield on his farm. Among the hundreds are a type of coin that has sold at auction for more than $100,000 — and there are about eighteen of them.

While the extraordinarily lucky man’s identity and the location of his property are still under wraps, his find has been certified by the Numismatic Guaranty Company (NGC), which describes itself as “the world’s largest and most trusted third-party grading service for coins, tokens and medals.” The treasure heap has become an instant numismatic legend, christened as “The Great Kentucky Hoard.”

BRICS MEETING STARTS TOMORROW//GOLD PRICE UP $7.15 TO $1894.30 WHILE SILVER WAS UP 59 CENTS TO $23.28//PLATINUM WAS UP $2.20 TO 914.60//PALLDIUM WAS DOWN $14.25//INTERESTING VIEWS: PETER SCHIFF AND CHRIS POWELL //ANOTHER NFL FOOTBALL PLAYER COLLAPSES ON THE FIELD AND THAT SUSPENDS THE PRE-SEASON GAME//OTHER COVID AND VACCINE UPDATES//SLAY NEWS/EVOL NEWS/NEWS ADDICTS//CHINA’S REAL ESTATE WOES WORSE THAN THOUGHT//UKRAINE VS RUSSIA UPDATES//UPDATES ON THE MAUI FIRE

BRICS MEETING STARTS TOMORROW//GOLD PRICE UP $7.15 TO $1894.30 WHILE SILVER WAS UP 59 CENTS TO $23.28//PLATINUM WAS UP $2.20 TO 914.60//PALLDIUM WAS DOWN $14.25//INTERESTING VIEWS: PETER SCHIFF AND CHRIS POWELL //ANOTHER NFL FOOTBALL PLAYER COLLAPSES ON THE FIELD AND THAT SUSPENDS THE PRE-SEASON GAME//OTHER COVID AND VACCINE UPDATES//SLAY NEWS/EVOL NEWS/NEWS ADDICTS//CHINA’S REAL ESTATE WOES WORSE THAN THOUGHT//UKRAINE VS RUSSIA UPDATES//UPDATES ON THE MAUI FIRE