from GoldSilver (w/ Mike Maloney):

TRUTH LIVES on at https://sgtreport.tv/

by Peter Schiff, Schiff Gold:

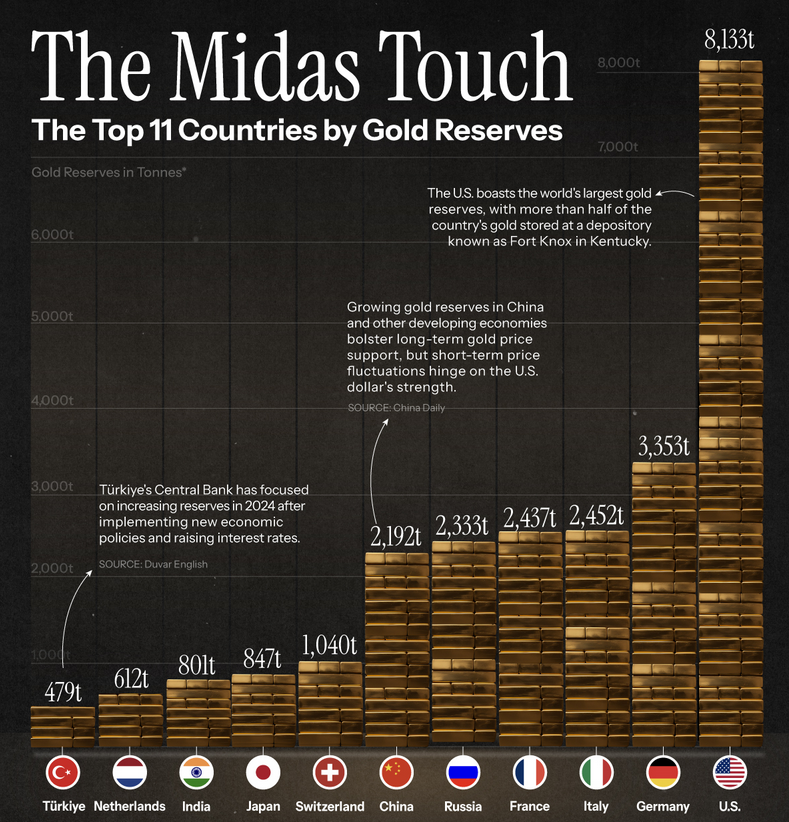

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

Last month marked the 17th in a row that the People’s Bank of China (PBOC) continued stacking gold. Notably, the bank typically reports lower numbers than its actual buying volume and is now also introducing a digital yuan to facilitate cross-border gold settlements.

by Mike Gleason, Silver Seek:

Another week, another record high for gold.

On Wednesday, the monetary metal surged above $2,300 per ounce. It took a bit of a breather Thursday ahead of today’s key employment report but it rallied again on Friday.

Turning to silver, it made a significant breakout of its own this week. The white metal shot up above the $27 level to a fresh 2-year high and rallied to over $27.50 on Friday

As gold prices continue to reach new heights, bulls are eying even higher highs. Detractors, meanwhile, are pushing the narrative that gold has gotten too expensive.

by Jim Willie, Gold Seek:

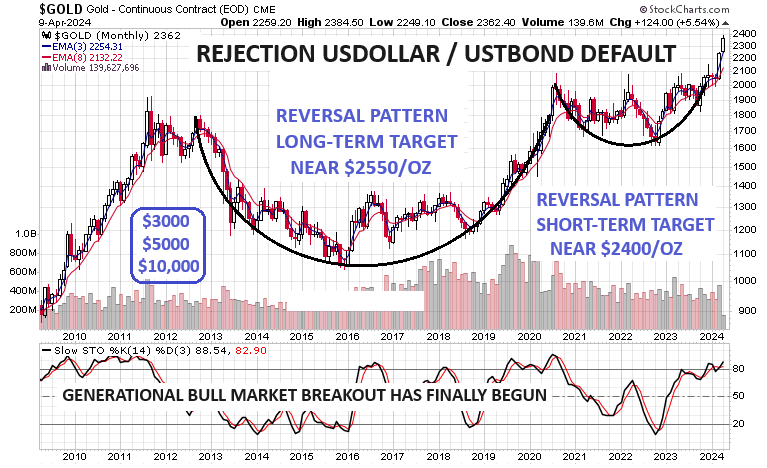

The time has come to cite the many reasons why Gold has risen, and why Gold will continue to launch to much higher levels. The USGovt debt and USTreasury Bond default, in my opinion, deserve the lead factors along with powerful price inflation. These factors are not featured in the press. The Jackass has stated for the last five years, to impatient clients and frustrated colleagues, that the Gold price will not break above the $2000 mark with moment in a sustained manner until the USGovt debt is widely perceived to be on a crash course toward default. WE ARE THERE, as even the prestigious St Louis Fed has publicly gone on record to call the USGovt debt as unsustainable. The picture of default is being painted.

from ZeroHedge:

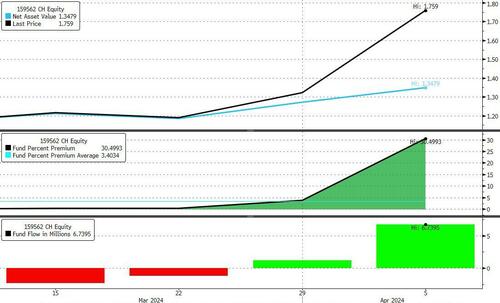

For the second time in a week, trading in an ETF that owns gold companies was halted in China overnight.

The ETF’s price had gained over 40% in the past four sessions before falling 10% after trading resumed Monday.

“The lack of alternatives, and the fact that it’s become a lot more difficult than it was a few years ago to get your money out of China and invest elsewhere – I think that’s definitely helping gold,” said Nikos Kavalis, managing director at consultancy Metals Focus Ltd.

“Demand is pretty decent, considering where the price is.”

Very rare photos of the US army seizing the weapons of mass destruction in Iraq pic.twitter.com/bSxK7Bc3fu

— S p r i n t e r F a c t o r y (@Sprinterfactory) April 6, 2024

by Dave Kranzler, Investment Research Dynamics:

Over the last few weeks, the resiliency of the gold and silver prices to repeated attempts by the price management squad to pull the rug out and send them plunging has been remarkable – if not unprecedented in the 23 years I’ve been studying, researching and trading the precious metals sector.

While the financial media attributes the big move in the metals to a marginal decline in the dollar, in fact it’s the rapid deterioration of underlying economic, financial and fiscal policy fundamentals that are causing the devaluation of the dollar and capital flight globally into gold and silver. This is despite the fact that the sharp move higher has left the metals technically vulnerable to a price ambush on the Comex.

from Peak Prosperity:

TRUTH LIVES on at https://sgtreport.tv/

by Jesse Colombo, BullionStar:

After more than three years of stagnation, gold has awakened with a vengeance since early-March and has promptly surged by nearly $300 an ounce or 14% to an all-time high $2,330 — a sharp move for a safe-haven asset that has a reputation for its slow and steady trends. Gold’s powerful rally came seemingly out of the blue and has confounded the majority of investors and commentators who have been much more focused on trendy speculative stocks and cryptocurrencies as of late. In this piece, I will explain several of the technical and fundamental factors that are driving gold to all-time highs, what is likely ahead for gold, and how investors can best take advantage of the yellow metal’s resurgence.

by Mish Shedlock, Mish Talk:

Costco periodically offers one ounce gold bars. They sell out immediately, scarfed up by millennials. Looking for other sources? I have one.

Gold Bars in the Shopping Cart

The Wall Street Journal comments on Gold Bars in the Costco Shopping Cart.

from GoldSeek Radio Nugget:

TRUTH LIVES on at https://sgtreport.tv/