by Jim Quinn, The Burning Platform:

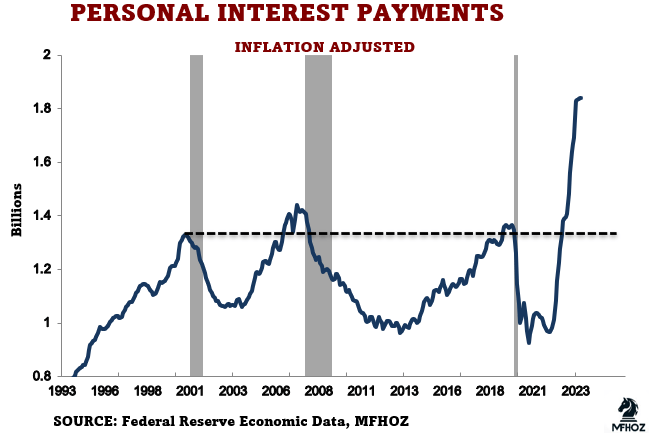

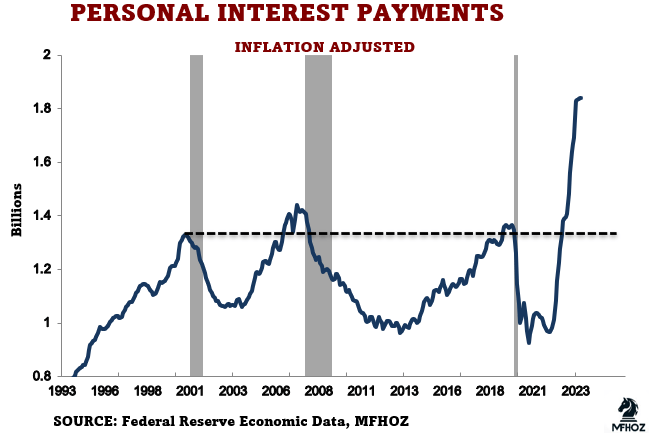

If ever a chart told the story of the biggest debt bubble in world history, it’s this chart of doom. Note that the numbers are inflation adjusted. Every time personal interest payments have reached $1.3 billion during this century, we went into recession. All precipitated by enormous bubbles (dot.com, housing, everything). I wonder what happens when they reach $1.8 billion?

TRUTH LIVES on at https://sgtreport.tv/

The everything bubble 1.0 was alleviated by trillions in covid scamdemic money thrown at it to keep this shitshow functioning. Of course, the trillions in debt created by the Fed ignited raging inflation, requiring interest rates going from 0% to 5%, therefore driving interest payments to their current level of $1.8 billion, 25% higher than they have ever been in history.

So now what? Will this time be different? Defaults on credit cards and auto loans are already the highest since 2009. Meanwhile, credit is still abundant and available to young people who are partying like it’s 1999. Tens of millions are using their credit cards to survive, paying their utilities and taxes on credit cards charging 24% interest. Senior citizens have to decide whether to pay for their medicines or food with their dwindling available credit lines.

But the stock market and bitcoin are at all-time highs, so don’t worry. This certainly won’t be the biggest credit collapse in world history. That chart means nothing. Reversion to the mean only happened in the past. The future is glorious. This is fine. Biden has everything under control.

Read More @ TheBurningPlatform.com