by Egon Von Greyerz, Gold Switzerland:

Tectonic shifts lie ahead. These will involve a US and European debt crisis ending in a debt collapse, a precipitous fall of the dollar and the Euro with Gold emerging as a reserve asset but at multiples of the current price.

The next phase of the fall of the West is here and will soon accelerate. It has been both precipitated and aggravated by the absurd sanctions of Russia. These sanctions are hurting Europe badly and affecting the US in a way that they didn’t expect, but was obvious to some of us. The Romans understood that free trade was essential between all the countries that they conquered. But the US administration blocks have both the money and the ability to trade of the countries they don’t like.

TRUTH LIVES on at https://sgtreport.tv/

But shooting yourself in the foot really hurts and the consequences are in front of our eyes. No foreign country will want to hold US debt or dollars. That is a catastrophic problem for the US as their deficits will grow exponentially in coming years.

So a debt collapse is not just a looming disaster but a bomb hurling towards the US economy at supersonic speed.

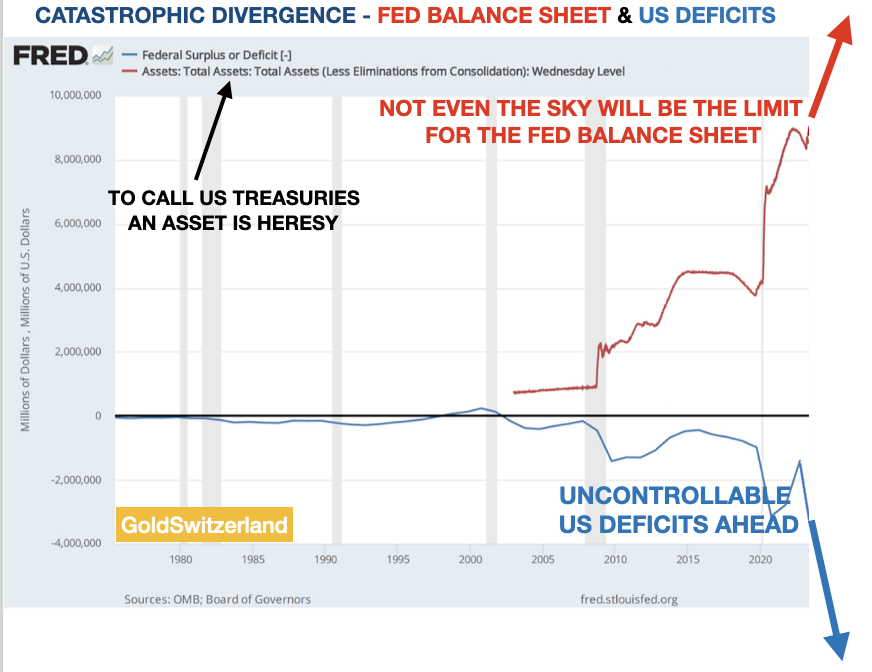

With the imminent death of the petrodollar and explosion of US debt, there is only one solution for the funding requirements of the US Government – the FED which will stand as the sole buyer of US Treasuries.

A CATASTROPHIC DEATH SPIRAL

So the DEBT spiral of higher debt, higher deficits, more Treasuries, higher rates and falling bond prices will soon turn into a DEATH spiral with a collapsing dollar, high inflation and most probably hyperinflation. Sounds like default to me but that word will probably never be used officially. It is hard to admit defeat even when it stares you in the face!

Yes, the US will probably obfuscate the situation with CBDCs (Central Bank Digital Currencies) but since that is just another form of Fiat money, it will at best buy a little time but the end result will be the same.

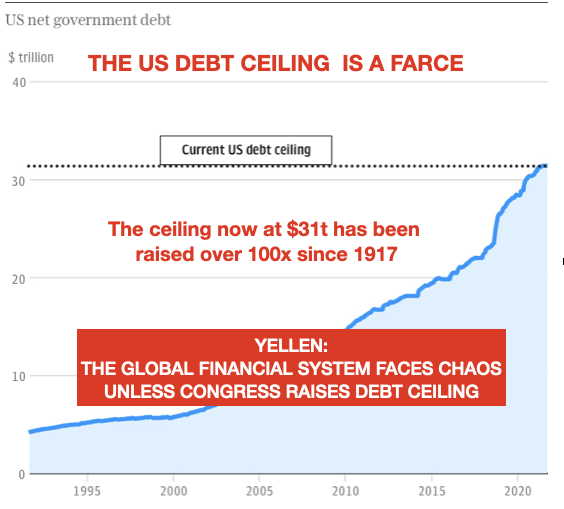

US Debt Ceiling Farce belongs to Broadway rather than Wall Street

The debt ceiling was created in 1917 as a means of restricting reckless spending by the US government. But this travesty has gone on for over 106 years. During that time there has been a total disdain for budget discipline by the ruling Administration and congress.

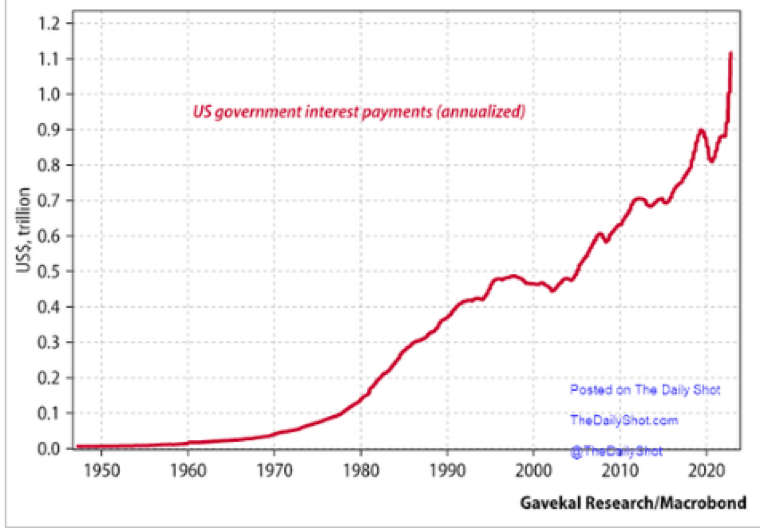

The problem is not just the debt but the cost of financing it.

The annualised cost of financing the Federal debt is currently $1.1 trillion. If we assume conservatively that the debt grows to $40 trillion within 2 years, the interest cost at 5% would be $2 trillion. That would be 43% of current tax revenue. But as the economy deteriorates, interest will easily exceed 50% of tax revenue. And that is at 5% which will probably be much too low as inflation rises and The Fed loses control of rates.

Thus a very dire scenario lies ahead and that is certainly not a worst case scenario.

THE FED IS BETWEEN A ROCK AND A HARD PLACE

The Fed and the thus US government are now between Scylla and Charybdis (Rock and a Hard Place).

As it looks today, the US will bounce between Scylla and Charybdis in coming years until the US financial system and also the economy takes ever harder knocks and goes under just as every monetary system has in history.

Obviously the rest of the West including an extremely weak Europe will follow the US down.

BRICS AND SCO – RISING POWERS

The whole world will suffer but the commodity rich nations as well as the less indebted ones will ride the coming storm far better.

This includes much of South America, Middle East, Russia and Asia. The expanding power blocks of BRICS and SCO (Shanghai Cooperation Organisation) will be the strong powers where a much increasing part of global trade will take place.

Barring major political and geopolitical upheavals, China will be the dominant nation and the main factory of the world. Russia is also likely to be a major economic power. With $85 trillion of natural resource reserves, the potential is clearly there for this to happen. But first the political system of Russia needs to be “modernised” or restructured.

What I outline above is of course structural shifts that will take time, probably decades. But whether we like it or not, the first phase, which is the fall of the West, could happen faster than we like.

A MONETARY SYSTEM ALWAYS ENDS IN A DEBT EXPLOSION

In 1913, total US debt was negligible, and in 1950, it had grown to $406 billion. By the time Nixon closed the gold window in 1971, debt was $1.7 trillion. Thereafter the curve has become ever steeper as the graph below shows. From September 2019 when the US banking system started to crack, the Repo crisis told us that there were real problems although no one wanted to admit it. Conveniently for the US government, the Repo crisis became the Covid crisis which was a much better excuse for the Government to print unlimited amounts of money together with the banks.

Read More @ GoldSwitzerland.com