by Wolf Richter, Wolf Street:

The “Pending Sales Jump” (still -24% year-over-year) was like so January. This is still a frozen housing market.

The “Pending Sales Jump” (still -24% year-over-year) was like so January. This is still a frozen housing market.

Funny how this works with the hype-and-hoopla show. The hype about the housing market picking up in January – it should pick up in January, and by a lot, because it’s the beginning of the spring selling season – was just deafening. But it’s already over, just weeks after it started.

TRUTH LIVES on at https://sgtreport.tv/

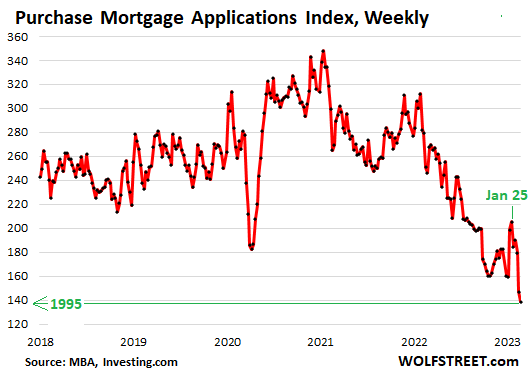

Applications for mortgages to purchase a home plunged every week since late January and now dropped to a new 28-year low. Mortgage applications to purchase a home are a leading indicator of home sales volume. They plunged by 44% year-over-year and by 48% compared to two years ago, to the lowest since 1995, according to data from the Mortgage Bankers Association today.

But note the rise in mortgage applications in January, from the collapsed levels in October through December. It was brief – at the core, just two or three weeks that peaked in the reporting week through January 25. And then it all came apart.

Homebuilders played a big role in the January-hype-and-hoopla show. They’re living off their backlogs because their sales orders in Q4 collapsed by 40% to 60%. Those sales orders, if they’re not cancelled, represent future revenues. Builders’ Q4 revenues and earnings derived largely from completing homes and closing sales from previous sales orders that were part of their backlog. They were eager to brush aside the collapse in sales orders in Q4, which represent future revenues. So they focused on the uptick in sales orders in January from the collapsed levels in Q4. Analysts went for it, and homebuilder stocks jumped, which was the purpose.

Then came the media’s breathless headline about “pending sales” for January a few days ago, by the National Association of Realtors. The media, always eager to hype housing, was all over it: “Pending sales jumped 8.1%,” and similar stuff, the headlines read. Jumped from what?

From the collapsed levels in DECEMBER. Compared to January a year ago, pending sales were still down 24%! But most people only read the headlines.

The 8.1% increase in pending sales from the collapsed levels in December was triggered by a brief and now vanished drop in mortgage rates toward 6%.

Everything bounced in January, stocks, bonds, cryptos. Bankruptcy equities and collapsed post-SPAC and post-IPO stocks doubled or tripled in days. As bond prices jumped, long-term yields fell, and mortgage rates too fell toward that 6%. And it caused a brief uptick in home sales from the collapsed levels in December.

But all that reversed in February. The 10-year Treasury yield is back at around 4%. The average 30-year fixed mortgage rate is now near the magic 7% again. Markets are finally starting to see ever so gradually that this inflation is sticky, that it re-heated in December and January, and that interest rates are going higher and staying there for longer.

And the spring selling season already fizzled. All this hype was based on what amounted to a two- or three-week period in January when activity perked up from the depressed levels late last year. But even at the peak toward the end of January, mortgage applications were still down by 32% from a year earlier and by 38% from two years earlier.

This is still a frozen housing market, that’s what these mortgage applications tell us. For sales volume to rise to normal levels, prices need to come down, and by a lot, to make sense with 7% mortgages.

There is a stand-off in the market, with many potential sellers, confused by all this hype, still thinking that this too shall pass, namely these mortgage rates, and that somehow the sub-3% mortgages will return to make their aspirational prices possible, even as inflation is eating everyone’s lunch, in some cases literally. And so they cling to their aspirational prices, or hold their vacant properties off the market, waiting for the return of the 3% mortgage rates.