from ZeroHedge:

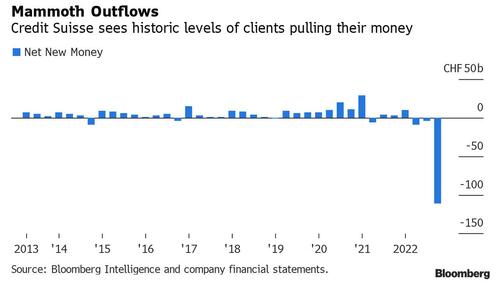

Back in late 2022, when Credit Suisse stock cratered to never before seen levels after a series of dismal earnings reports and regulatory “missteps” sparked a staggering bank run, amounting to some $88 billion forcing the bank to seek emergency liquidity from the Fed via SNB swap lines, and which also led to a historic corporate restructuring which included the de facto closure of the bank’s investment bank coupled with mass layoffs and bonus cuts, many thought that would be as bad as it gets as the (rapidly changing) management had finally thrown out the kitchen sink.

TRUTH LIVES on at https://sgtreport.tv/

Boy, were they wrong.

On Thursday, Credit Suisse shares tumbled as much as 12%, after the Swiss bank unexpectedly posted a bigger-than-expected loss for the fourth quarter and even more unprecedented client outflows, exacerbating the difficulty for new CEO Ulrich Koerner in returning to profitability by next year.

The second-largest Swiss bank (although it’s probably far smaller now) posted a fifth-straight quarterly loss of 1.39 billion Swiss francs ($1.5 billion), worse than consensus estimates of a 1.14 billion loss as revenue of 3.06 billion Swiss francs also handily missed expectations of 3.35 billion. But while the operating loss was hardly a shock for a bank which has been in a constant state of chaos and turmoil, what stunned analysts was what KBW analysts called a “quite staggering” level of customer capital outflows which hit a record 110.5 billion francs in the quarter, and although the bank said that some money has been coming back, it also concedes it’s now at a worse starting point for 2023.

That was also the big reason why Credit Suisse gave an outlook for the first quarter and the full year that one analyst has labeled as “bleak.” The bank said it will post a “substantial” pretax loss in 2023; the fact that it knows this just one month into the year is very concerning, and as Bloomberg Intelligence analysts said, the scale of outflows and a plunge in investment-bank revenue “frame the difficulties ahead.”

As Bloomberg notes, Koerner’s pledge to stem the decline hinges on a massive client outreach program to woo nervous clients and their cash back to the bank, while carving out the volatile investment bank and slashing costs. On Thursday, Credit Suisse reported progress in the steps needed to execute the plan, including the purchase of dealmaker Michael Klein’s boutique advisory firm, but only tentative signs that customer confidence is returning.

By “2024 I think we should be profitable,” Koerner said in an interview with Bloomberg Television’s Francine Lacqua. “2023 will be a transformative year, and then we get better and better,” he said; of course he has no way of knowing that, and in the meantime, his guidance means that 2023 will be another year of losses; hardly the stuff that will inspire either employees to stay with the bank (especially since their bonuses are now well below street comps) or investors to buy the stock.

And while the bank’s decline has been duly documented here, here is the punchline: Credit Suisse’s total assets under management stood at just 1.3 trillion Swiss francs at the end of 2022, a decline of almost 20% from a year earlier.

There was some other tangential news reported by the bank, including:

- The bank also confirmed a Bloomberg scoop by saying that it will slash its bonus pool by half compared with last year, raising questions about its ability to retain staff. It also unveiled a “transformation award” for a limited number of staff that’s one response to those concerns.

- Additionally, the investment banking carve-out of Credit Suisse First Boston – yes, Credit Suisse is so ashamed of its name it hopes to gradually transition into the bank it bought two decades ago – is taking shape, with the absorption of Klein’s boutique firm in a deal valued at $210 million and an intention to publicly list or spin off the unit by the end of 2024. And on costs, Credit Suisse has managed to cut 4% of staff, inching towards the 17% or 9,000 total job cuts they plan by 2025.

But none of that mattered as investors were far more concerned by the ongoing erosion of the core franchise – if one even exists – and the continued barrage of bad news from the bank which just seems unable to “kitchen sink” its problems, and reacted with dismay to the announcements pushing Credit Suisse’s shares down by as much as by 6.1%, the steepest decline in three weeks, pushing the stock just a dime above its all time low.