by Steve St. Angelo, SRSRocco Report:

The U.S. government just released its November Treasury Statement with a shocker that the Debt-Service Interest Expense surged 50% in the first two months. This is a great deal of money when it equals nearly the same value for World Transparent Silver Holdings.

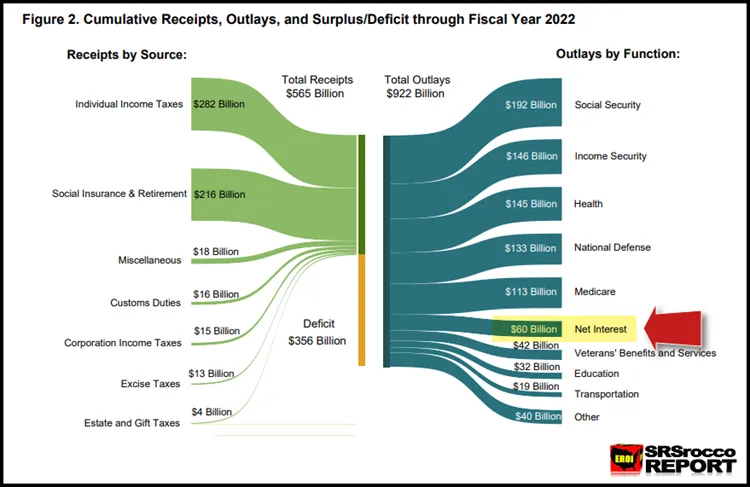

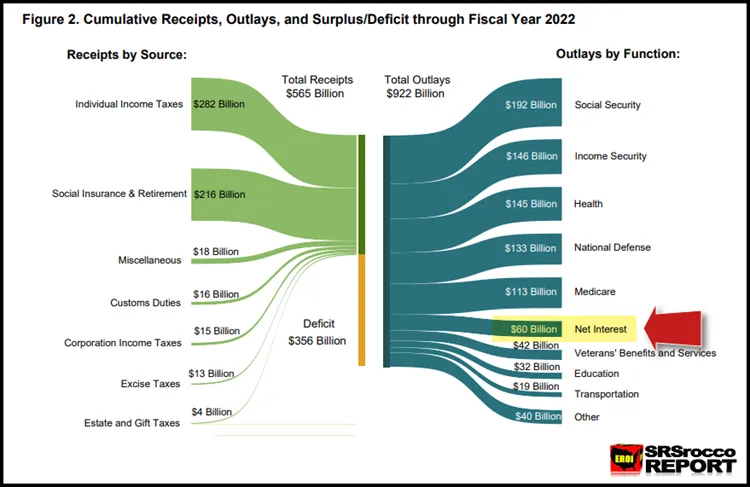

So, how much did the U.S. Interest Expense increase in the first two months of fiscal 2023? Let’s look at the following charts from the November Treasury Statements.

The U.S. government paid a total “Net Interest” Expense of $60 billion for October-November 2021.

TRUTH LIVES on at https://sgtreport.tv/

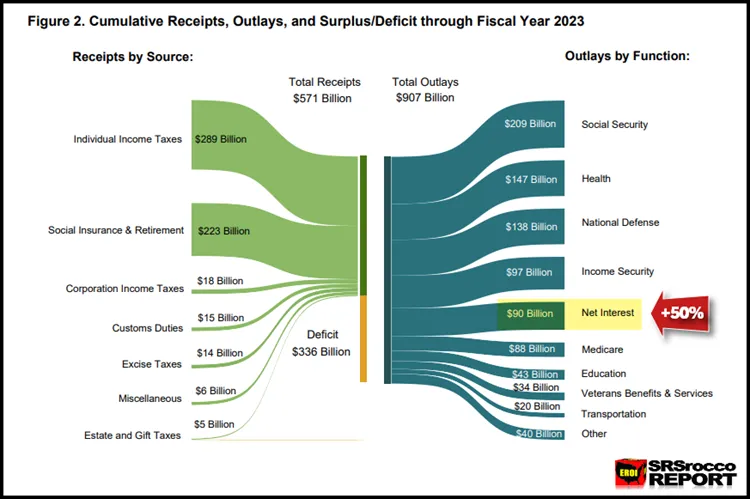

Now, look at what was paid for October-November 2023:

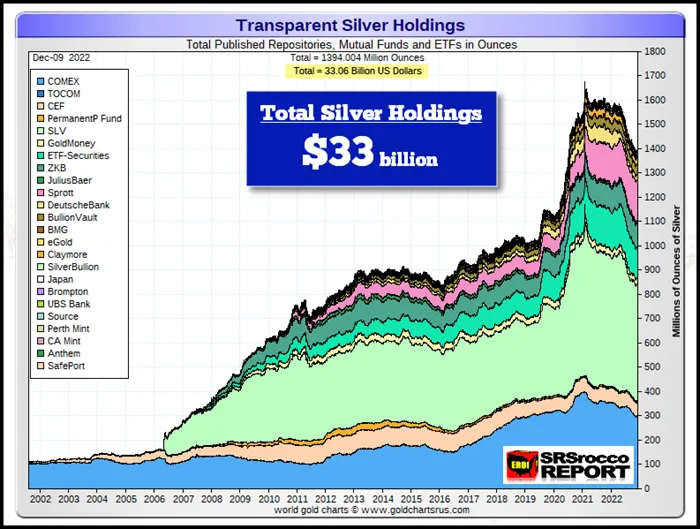

The U.S. Treasury forked out an additional $30 billion for a total of $90 billion (just for October & November) to service the U.S. Debt, now at $31.3 trillion. Amazingly, this is a 50% increase year-over-year. Folks, $30 billion is a lot of money and represents nearly the same value as World Transparent Silver Holdings:

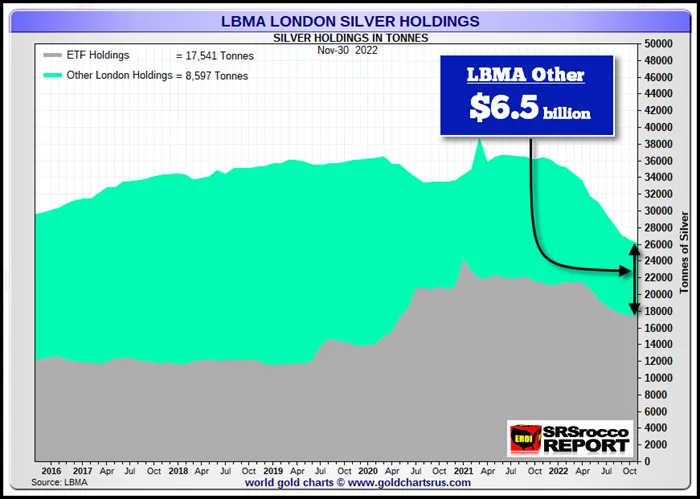

If we look at the following chart from GoldchartsRus.com, shows total World Transparent holdings at 1,394 million oz, valued at $33.06 billion. However, the amount does not include the additional silver held in the LBMA. If we consider just the “LBMA Other” silver, it would be approximately $6.5 billion. The LBMA other category holds 276 million oz of silver, which “IS NOT” allocated to the Silver ETFs shown in the World Transparent Holdings chart above.

TWO IMPORTANT POINTS: 1) You will notice that the LBMA Other silver inventories have declined significantly since 2019. In 2019, the LBMA Other silver category represented roughly two-thirds (66%) of all the silver held in the LBMA vaults. Today, the LBMA’s other silver category is only ONE-THIRD (33%), with the remainder set aside for the Global Silver ETFs.

Read More @ SRSRoccoReport.com