by Michael J. Kosares, Gold Seek:

Since the World Gold Council reported that it could not identify the source for 300 tonnes in official sector gold demand in early November, speculation has been rife about who the whale might be. Opinion is now coalescing around China as the buyer in question, according to a recent Nikkei Asia report. “China likely bought a substantial amount of gold from Russia,” analyst Itsuo Toshima told Nikkei. There is some evidence to support the claim. Chinese customs authorities, according to the same report, announced an “eightfold” surge in gold purchased from Russia in July. In addition, the report cites China selling $121.2 billion in U.S. Treasuries this year, “the equivalent of roughly 2200 tonnes of gold.”

TRUTH LIVES on at https://sgtreport.tv/

Likening central bank gold buying to an elephant jumping into an already full swimming pool, Lombardi Letter’s Moe Zulfiqar says he “can’t help but be bullish” on gold’s future prospects based on the enduring presence of central bank demand. “Something amazing is happening in the gold market,” he says in an advisory released in mid-November, “but it’s largely going unnoticed: central banks are buying gold at a record pace. This could be a big catalyst that sends gold prices toward $3,000 per ounce much sooner than previously expected.…”

“One of the worst-kept secrets in global central banking is the extent to which Chinese officials are swapping dollars for gold,” writes analyst William Pesek in an Asia Times piece. Though it is impossible to get a fix on China’s involvement in the gold market without an admission from the Peoples Bank of China, Pesek’s article does a good job of sifting through some of the inferences. He saves his most intriguing comment for last: “[T]he longer-term trajectory for global currency markets remains dollar-negative as China and other top Treasuries-holding powers switch into an asset John Maynard Keynes once dismissed as a ‘barbaric relic.’ That relic is now flashing red alert for dollar bulls.”

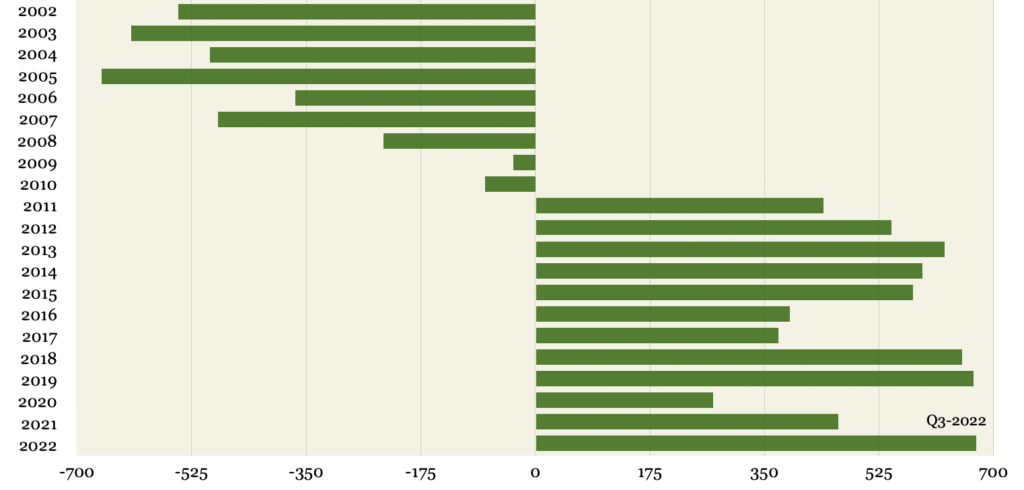

Central Bank Gold Sales and Purchases

2002-2022 (Q3) (net; metric tonnes)

Chart by USAGOLD [All rights reserved] • • • Data Source: World Gold Council

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The six keys to successful gold ownership

This eye-opening, in-depth introduction to precious metals ownership will help you avoid many of the pitfalls that befall first-time investors. Find out who invests in gold, what role gold plays in serious investors’ portfolios, and the when, where, why, and how of adding precious metals to your holdings. To end right, it is critical that you start right, and the six keys to successful gold ownership will point you in the right direction.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short & Sweet

“FOR MOST ANALYSTS, THE LIQUIDITY PROBLEMS in the Treasury market are not just about rapidly changing prices, they are also a reflection of a dearth of buyers or an inability or unwillingness of the buyers in the market to mop up all the supply,” reports Financial Times. That absence of buyers is the result, for the most part, of both the Fed and the Bank of Japan withdrawing from the Treasuries market as buyers. Those cracks, in short, could quickly become major fractures unless buyers are found elsewhere. As FT points out, in the event of another crisis, the Fed would likely halt quantitative tightening or even return to quantitative easing, as did the Bank of England under similar circumstances a few months ago. Such a retreat from stated policy, though, would not communicate “the kind of stability and security that investors around the world depend on,” says FT.

IN A BLOOMBERG ESSAY, STANFORD HISTORIAN NIALL FERGUSON walks us through the anatomy of the FTX scam and how it fits into the long history of such misadventures……Ferguson does not have nice things to say about Bankman-Fried, but what happened with FTX is nothing new in financial markets. “Time and again,” he writes in an extended essay titled FTX kept your crypto in a crypt, not a vault, “share prices have soared to unsustainable heights only to crash downwards again. Time and again, this process has been accompanied by skullduggery, as unscrupulous insiders have sought to profit at the expense of naive neophytes.” And crypto, let us not forget, was promoted with great enthusiasm (and disdain for those who questioned it) as a New Age alternative to gold.

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

[WE’RE LONG-STANDING FANS OF INVESTING IN GOLD,” says Money Week magazine. “We think it’s a great way to provide insurance against any future financial crisis. Or inflation. If you want a truly diversified portfolio, invest some of your assets in gold.… Classic European and world gold coinage is an often overlooked, but extremely important sector in today’s gold market. These coins are rare which means they have more potential to appreciate in price yet, they can often be bought at bullion prices.” It goes on to specify British sovereigns as an item that enjoys “excellent liquidity in most countries in the world.” At USAGOLD, we have placed large numbers of this item with investors over the years. It remains our most popular classic gold coin with the Swiss 20 franc a close second.

“TODAY WE ARE EXPERIENCING THE WORST ELEMENTS of both the 1970s and 2008. … Everyone should be preparing for what may be remembered as the Great Stagflationary Debt Crisis,” Nouriel Roubini writes in an apocalyptic assessment he calls The Age of Megathreats (Project Syndicate). Dr. Doom outdoes himself in this extended essay in which he concludes: “Avoiding a dystopian scenario will not be easy.” He reiterates his investment advice covered in this letter previously, i.e., the need to hedge the risks just listed in a stagflationary environment. He recommends “short-term government bonds and inflation-indexed bonds, gold and other precious metals, and real estate that is resilient to environmental damage.”

ELLIOT MANAGEMENT, THE HIGHLY INFLUENTIAL HEDGE FUND managed by Paul Singer, warned recently that the world is on the road to “hyperinflation” and the worst financial crisis since World War II. According to a recent Financial Times report, the fund blamed central bank policymakers for the “looming crisis,” saying they have been dishonest about the cause of the inflation problem, which, in its view, is the result of ultra-loose monetary policy, not supply chain bottlenecks. Despite the regularity of financial shocks since the 1970s, “investors should not assume they have seen everything,” says the firm. Elliot warns that hyperinflation could lead to a “global societal collapse and civil or international strife.” Singer is a long-time advocate of gold as a hedge against the kind of uncertainties covered in his firm’s latest advisory.