by Peter Schiff, Schiff Gold:

The Fed has talked a big game lately. Many people (including me) assumed the Fed would fold a long time ago. There is a very good reason — the Fed will crush the economy and the US Treasury with higher interest rates.

In reality, the Fed is holding a losing hand and trying to bluff its way to victory.

The following analysis is by SchiffGold’s data analyst.

So far, the Fed has defied the skeptics, stuck to its guns, and pressed forward. Despite the hawkish stance, we can actually still be sure the Fed is bluffing.

TRUTH LIVES on at https://sgtreport.tv/

Everyone knows that at some point the higher interest rates will prove catastrophic. Putting a precise timeline on it is difficult, but also not impossible. Someone can actually run the numbers and see when the Fed will be forced to show their cards. So that’s what I did.

How?

I started with data published by the Treasury that shows their entire debt schedule each month down to the Cusip level. It shows the maturity dates and the interest rates. First, I ran a mini-Monte-Carlo using different fixed rates to see the general impact. Next, I combined the Treasury data with the Fed’s own forecast. As debt rolls over, I replaced maturing debt with new debt at the Fed’s forecasted rate.

I made a few assumptions for simplicity:

-

-

- The calculation was only run on Marketable debt, specifically Bills, Notes, and Bonds

- I added $100B a month in new debt plus the additional interest expense

- I applied the same rate to all maturity levels (the yield curve is currently inverted but also pretty flat relative to history)

- When debt rolls off, I replace it with the same maturity schedule (e.g., 2-year notes roll back into 2-year notes)

-

Let’s start with the mini Monte Carlo using different interest rates.

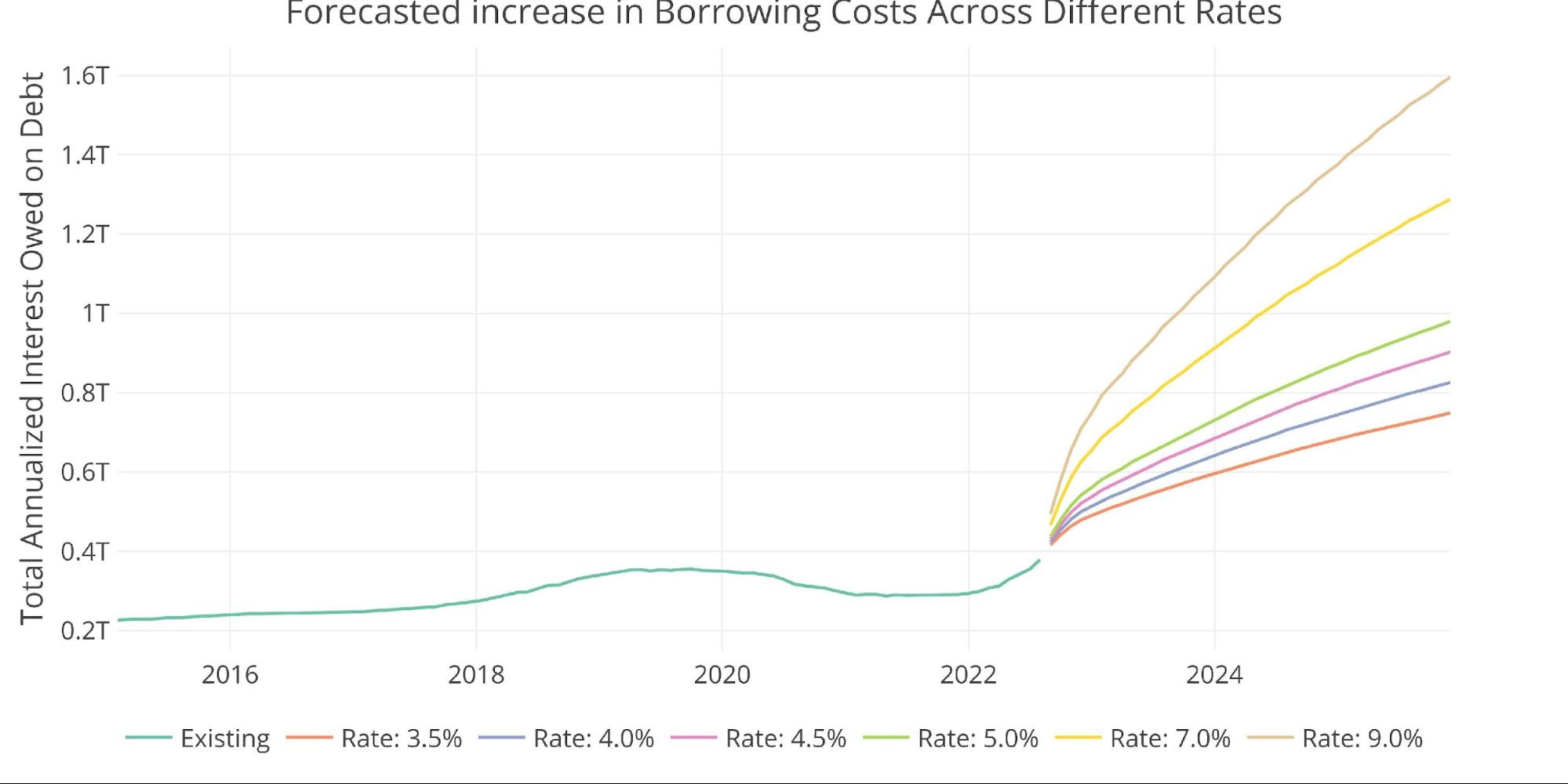

Figure: 1 Comparing Different Rates

Bam! Even the most conservative case (3.5%) shows that the debt gets unruly in a hurry. Under this scenario, the treasury is paying $600B a year in interest by January 2024. That is more than double the interest expense as recently as February 2022. Yes, double! And this is the scenario if the Fed were to freeze raising rates right now!

But, noooooo. The Fed needs to show they are serious. Powell is the new Volker and he has to prove it or the Fed could lose all credibility. So, last week they doubled down on their bluff. By the end of the year, they now anticipate rates at 4.4% rising to possibly 5% next year.

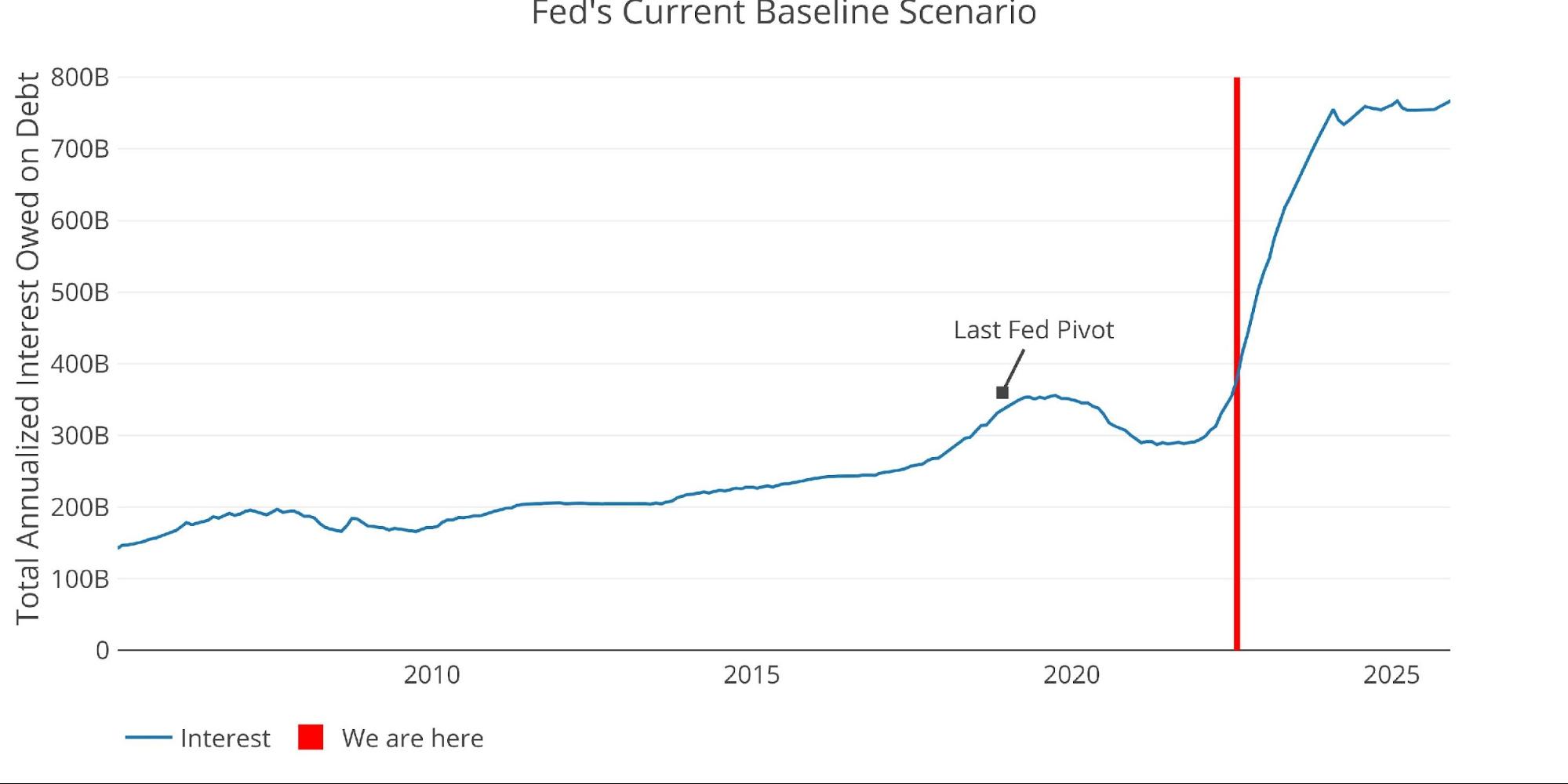

OK fine, let’s actually create this exact scenario. 4% in November, 4.4% in December, 5% in March 2023 for a full year, and then slowly lower rates in mid-2024 back to 3% by 2025. This is the Fed forecast.

Figure: 2 The Current Fed Scenario

Take a minute to digest the chart above. Note how the next few months look relative to the last 20 years. This is not just a little extra strain on the economy. By Jan 2024 the Treasury will be hemorrhaging $740B in interest! That is almost $500B more than the Treasury was paying in 2021. Half a trillion dollars a year more in interest… in 15 months!! Remember when people freaked out about sending Ukraine $40B? This is 12x higher!

These are not made-up numbers or a worst-case scenario. This is using actual Treasury data against the Fed’s actual base case scenario. This is what’s going to happen if the Fed sticks to its current plan. Remember in 2018 when the Fed had to fold cause the market threw a fit? It’s marked on the plot above in case you forgot. Well, we just blew past that level in June.

The Fed is moving much faster this time, but the data is still on a lag. It’s going to take time for the Fed to notice when they have actually broken something. I’ll let you in on a secret though, they have already broken something… they just don’t know it yet (or maybe they do – just look at the currency markets). They moved slower in 2018, they had time to watch the data and see when the market started to convulse. It then took time for the interest level to peak and come back down after the pivot.